In an oddly-timed-release, just a day after her 'unusual' meeting with President Obama (and sandwiched between two "emergency Fed meetings"), Janet Yellen's seemingly legacy-protecting narrative-confirming interview with TIME magazine proclaiming once again that "we are focused on Main Street, on supporting economic conditions - plentiful jobs and stable prices - that help all Americans." So now you know - it's all for you America - the bank bailouts, the deflationary-glut-creating ZIRP, the money-printing, and the "confusing and confounding" messaging. Now stop your complaining and Vote Hillary!

As TIME reports, you don’t often hear central bankers say, “I don’t know.” That’s because monetary wizards, like brain surgeons and rocket scientists, tend to cultivate an aura of omniscience. Their vast underground computers crank out supposedly precise answers to complex questions about where the global economy will be in the next five minutes or the next five years. But Federal Reserve Board Chair Janet Yellen has never been allergic to uncertainty.

In a recent interview with TIME, she made it clear there are plenty of things about the economy both at home and abroad that the Fed—not to mention economists, investors, politicians and the rest of us—doesn’t grasp right now. Unemployment has dropped to pre-crisis levels, but wages remain stagnant. The traditional relationship between job creation and inflation seems to have broken down. More and more technology has not boosted productivity, as it has in the past. Asset classes like stocks or bonds no longer move together in the ways they used to. In short, the global economy is playing by new rules, rules Yellen and the Fed itself are trying to puzzle out. “Sometimes you have to make decisions without knowing all that you would like to know,” she says. “That’s part of the job.”

This new reality is partly the result of the $29 trillion that central bankers pumped into the global economy over the last few years. (The Fed alone dumped $4.5 trillion in the U.S.) Central bankers were forced to take such steps because gridlocked governments didn’t act to put more fiscal stimulus into their economies after the 2008 financial crisis. They became, as economist Mohamed El-Erian has written, “the only game in town” for propping up growth. The downside of the recovery: distortions in corporate debt and equity markets and the risk of another crash.

The Fed has frequently been criticized, particularly by Republicans but also by some on the left, for continuing to keep rates low in such an environment. By many metrics, the American recovery is improving, and easy monetary policies have been known to encourage risky financial behaviors of the sort made infamous in 2008. But Yellen sees herself less as a wizard that backs into numbers via computer models and more of a family doctor who’s taken an oath to first do no harm. “We necessarily operate in an environment in which there’s a great deal of uncertainty,” she notes, talking about everything from the Chinese financial markets to the future of European integration.

“In such an environment, it makes sense to use a risk-management approach to identify and avoid the big mistakes. That’s one reason I favor a cautious approach.”

Yellen, in other words, is not keen to rely only on old models. Rather, she is sending scouts out to map the new landscape, measuring and analyzing data. The hope is to be able to quickly change tack as the economy continues to twist and turn and confound.

For Yellen, “risk management” means doing everything she can to keep the U.S. recovery on track, employment especially. That’s one reason rates remain low. If she had to choose between worrying about financial bubbles or jobs in the Midwest, she’d choose the latter. It’s an approach consistent with her kitchen-table approach to economics—more focused on the empirical than the theoretical.

That’s a big shift from past regimes at the Fed, which have trended toward the academic. “We are focused on Main Street, on supporting economic conditions—plentiful jobs and stable prices—that help all Americans,” she says.

So - having said all that, here is some fiction-peddling... here's a reminder of what "mission accomplished" looks like:

The 'smartest people in the room' cut interest rates, lowering the cost of capital to the lowest in 5000 years...

But a funny thing happens when the world is saturated in debt, leveraged to the max, and liquidified by lenders of last resort... the textbook breaks!

And the real economy "gets nothing"

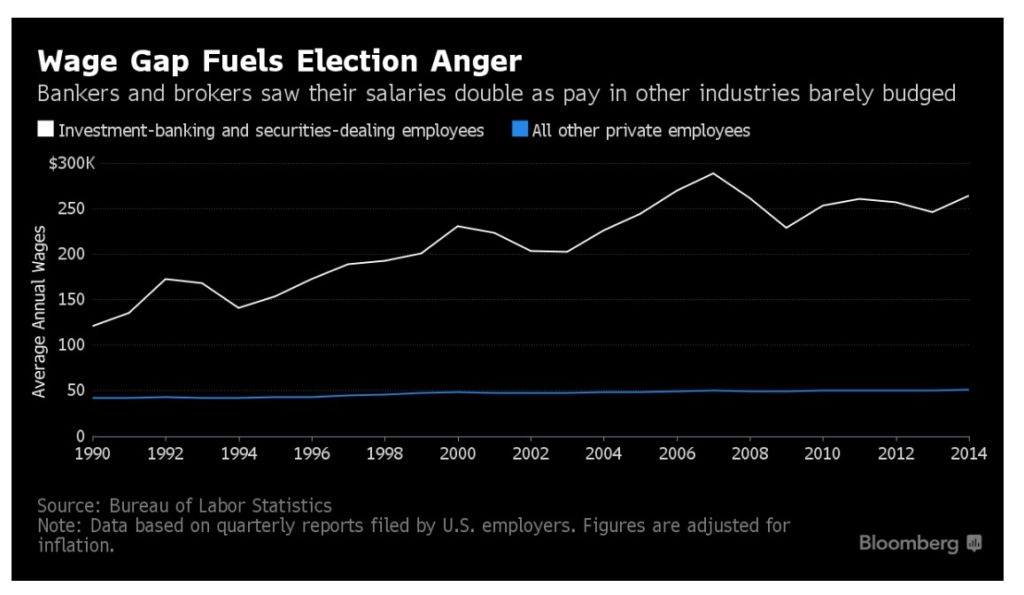

Because bankers got it all..

But before we blame Janet, it's not the person... it's the institution since Greenspan... Near record high stock prices and near 40-year-low employment participation may not sound "pleasing" to some.

So, as Mike Krieger concluded so eloquently...

The next question one should ask is, how has Wall Street helped the U.S. in order to deserve such incredible financial success? Well they mass produced fraudulent products, destroyed the global economy and then demanded a massive taxpayer bailout for starters. A year after the banker bailouts, Wall Street bonuses were at record highs, while Americans were still being kicked out of their homes. That’s about as close a link you’re going to find between Wall Street and Main Street.

The reason we bring this up today is not to increase the public’s rage against the bloated financial sector and the obvious harm it does to society, but to highlight an example of how the status quo invents and propagates a myth in order to deceive the public. The good news is that they always keep recycling the same myths, so once we understand their game plan, the potency of their lies diminishes. Let’s make sure they can’t use the Wall Street/Main Street one ever again.

With "help" like this, who needs enemies?