By Chris at www.CapitalistExploits.at

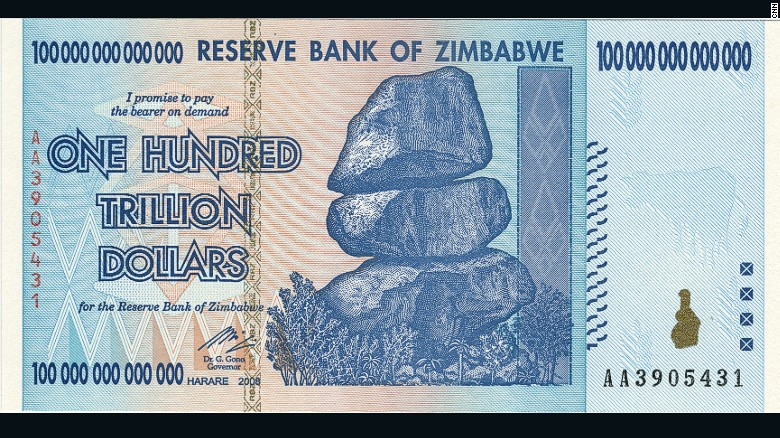

Earlier this week I discussed Zimbabwe - the country that took and continues to take ineptitude to a whole new level.

Specifically, we discussed how the liquidity of assets gets impacted when things go really pear shaped. I think it's worth understanding this process. There are certain dynamics that are very pertinent to countries and economic systems which we've come to incorrectly associate with stability, safety, and people who, with their hand on the tiller, really should know better. But based on their actions they clearly don't.

As mentioned, Zim had a serious problem with liquidity and collateral. Like hydrogen and oxygen they can be tightly interconnected, and when they are (in the right formation) we get something almost miraculous (it keeps us alive) but when they're not they're just... meh.

Under the watchful eye of their great leader Zimbabwe had - and in fact still has - a massive problem with its collateral since it became worthless and consequently liquidity dried up.

Liquidity, at its very foundations, is a consequence of trust, and collateral can't be created or maintained without trust. I suggest reading or re-reading my article on collateral where I argued that the basis of a healthy global financial system is an ability to create collateral - something central banks and governments have been actively destroying but I digress.

Anyway, I promised you in my last article that there was a solution to all of this.

I'll tell you what I think is going to be THE solution for this sort of problem in the next couple of decades if not sooner, but first (and in order to provide additional context)... let's cover what solutions did crop up for this truly buggered country because they provide us a glimpse into some of the components necessary to solve these sorts of problems.

Not to belabour the point but Mugabe and his cronies made a truly epic mess of the place.

Everyone became a billionaire and promptly proceeded to starve. Even that mad bitch Kirchner from that other Southern land of great steaks never cocked things up this badly, and she really was one daft bat. Everyone knows that the worst harm you can do to any man, after forcing him to go shopping and spending time with his mother in law (or both together), is to destroy his store of value and means of exchange.

Mugabe did just that.

Add in capital controls and folks had precious few places left to move their capital to.

Enter Old Mutual.

Old Mutual is a holding company involved in asset management, life insurance, banking, and a few other bits and pieces. What matters is that Old Mutual is listed on the LSE, the JSE, and on the Harare Stock exchange. Bingo!

At any given moment in time you could, with the help of Google, figure out what the value of something in Zim was because you could get the quote on Old Mutual stock on any of these exchanges. Old Mutual stock, as well as some other dual listed equities, quickly became currency. You could buy a nice steak in a restaurant in Harare or Bulawayo with the shares.

Here's OML overlaid with the USD/ZWD. That purple straight line up is when the peg inevitably broke (as all pegs eventually do) and the ZWD was laid to rest into the graveyard that all fiat currencies must finally lay in.

Even the government themselves landed up using Old Mutual stock as a currency:

Old Mutual shares used to pay for electricity imports

The Reserve Bank of Zimbabwe, which had stopped the fungibility of Old Mutual shares, was reported to be buying the shares on the Zimbabwe Stock Exchange and transferring them to the Johannesburg Stock Exchange to pay for electricity imports from South Africa’s Eskom.

Old Mutual shares traded in Harare, Johannesburg and London and had become a form of currency.

Press reports said the central bank was buying Old Mutual shares in Harare and transferring them to Johannesburg where they were held in the pension fund of Eskom as collateral.

And this brings me to where things are headed...

You see, the problems that Old Mutual shares solved were: one of transparency, which is sorely needed when the value of the currency you're transacting in is dropping faster than CNN's credibility.

In addition to transparency, what's needed is a relatively frictionless means of transacting. This, when provided, has an exponential multiplier effect on liquidity.

It's the same reason why it's easier to sell a loaf of bread in Manhattan than it is a mine in Kinshasa. The loaf of bread requires far fewer licences, deposits in local politicians' Swiss bank accounts, and purchase of "gifts".

With Old Mutual Zimbabweans had a listed equity whose value was easy to compute, already divided (shares), and easily transacted via a broker without additional bribes.

The other thing that Old Mutual provided was a relative store of value.

The shares, after all, represent real assets producing real cashflows, which is just another way of saying fundamentals underpin the company value. And there we are back to trust and collateral creation I spoke about before.

The Future

Stick with me here... Stretch your mind and consider what's taking place in the ICO (initial coin offering) space right now.

ICOs are amazing financial innovations birthed from blockchain technology that uses a cocktail of cryptology and mathematics stirred into a glass of software. When combined with multiple computers across networks blockchain creates tamper-proof record systems.

It tastes better than anything man's managed to dream up before. Blockchain technology is central to the business models of all of these ICOs.

What's very cool, though, is that many of the hurdles associated with doing business with either Ivan the naive Russian or Lucky (no kidding), the newly crowned gold mine owner in Zimbabwe, can largely be eliminated with the use of this technology.

Imagine placing Lucky's shiny new gold mine on the blockchain with any number of particular conditions (who performs what, when, and why) - all executed via a smart contract.

There is no need for lawyers or government officials to "help" transfer assets, administer scraps of paper for a bribe, or even to negotiate revenue-sharing deals (which is what we did incidentally).

Now, I realise I'm being somewhat simplistic here and you're not going to eliminate the threat of some lunatic deciding that you look awfully like Cecil Rhodes' offspring and wanting to chop off your head and take any physical asset that you own. But many of the moving pieces which created so much friction can be completely 100% eliminated with blockchain technology.

Now, what happens when more and more assets are placed on a system where they can be seen and transacted by any party anywhere in the world?

When we were looking at assets in Zimbabwe, there were a dozen (maybe) other serious guys hunting around. The time, energy, and cost to get on the ground and do that is not nothing. And yet I know for a fact that there are thousand, probably millions, of others out there who would have liked to participate but didn't have the time, energy, skills, resources to do so.

When they get a platform on which they can do so rest assured liquidity will come to all manner of assets previously never considered.

How many crazy Russians sweating last night's vodka out of their pores in saunas in Moscow would take a crack at assets like these if they could do so from their smartphones?

Of course, it's not just assets in beaten up broken places like Zimbabwe that we're talking about here this goes for any asset anyplace.

That day is coming, and the answer to my question posed is that liquidity increases due to network effects taking hold.

We're well past the industrial age here, folks.

Sure, physical assets such as mines, railroads, and power stations are valuable but they're far less valuable than ever before. This is only going to become more so as robotics, automation, and things like additive printing accelerate, decentralising product creation.

A Question to Ask Yourself

What is the most valuable "stuff" in the world today?

It's intellectual property.

Don't believe me?

Take a look at the top 10 most valuable companies in the world today and ask yourself this.

What is the most valuable components to their businesses?

It sure ain't Apple's factories in China or Google's Googleplex in Mountain View.

The value is in IP and that, folks, can be stored and transacted with far greater security, efficiency, speed, transparency, and at lower cost using Blockchain technology than anything else in existence today.

ICO's for Anything You Can Imagine

Probably the most well known ICO so far has been that of Ethereum, which raised $18 million 3 years ago and they did so by selling tokens that facilitate online contracts. Today, contracts based on the Ethereum protocol are proliferating, and consequently the Ethereum tokens have a market cap of $30 billion as I write this.

The geeks, building, testing, and breaking stuff in the ICO lab right now are busy building the framework and infrastructure for how everything is going to be transacted in our near future. A world where assets and services become currency or quasi currency themselves is where we're headed... and why the hell not?

Now, before you run out and begin buying a bunch of ICOs realise that probably 90% (I'm being generous here) of these ICOs are going to be 100% garbage, and that's not counting the ones that will be outright frauds.

What's going to happen is that a few widows and orphans will lose money which they really can't afford to lose and stern faced men in pointy shoes who still wear ties will clamp down on how this is done. That hasn't happened yet.

This is the wild, wild West but realise that even when it does inevitably happen it will only really be the beginning because useful groundbreaking technology once unleashed it's a lot like toothpaste.

- Chris

"Big companies desperately hoping for blockchain without Bitcoin is exactly like 1994: Can’t we please have online without Internet?" — Marc Andreessen

--------------------------------------

Liked this article? Don't miss our future missives and podcasts, and

get access to free subscriber-only content here.

--------------------------------------