Bailins Coming In EU - 114 Italian Banks Have NP Loans Exceeding Tangible Assets

- Italy opposes ECB proposal that holds banks to firm deadlines for writing down bad loans- Italy's banks weighed down under €318bn of bad loans- New ECB rules could 'derail' any recovery in Italy's financial system- Draft proposal requires banks to provision fully for loans that turn sour from 2018- ECB insists banks have better access to collateral on delinquent debt to solve problem- Investors should secure assets as proposal suggests more bailins on horizon and banks remain at risk

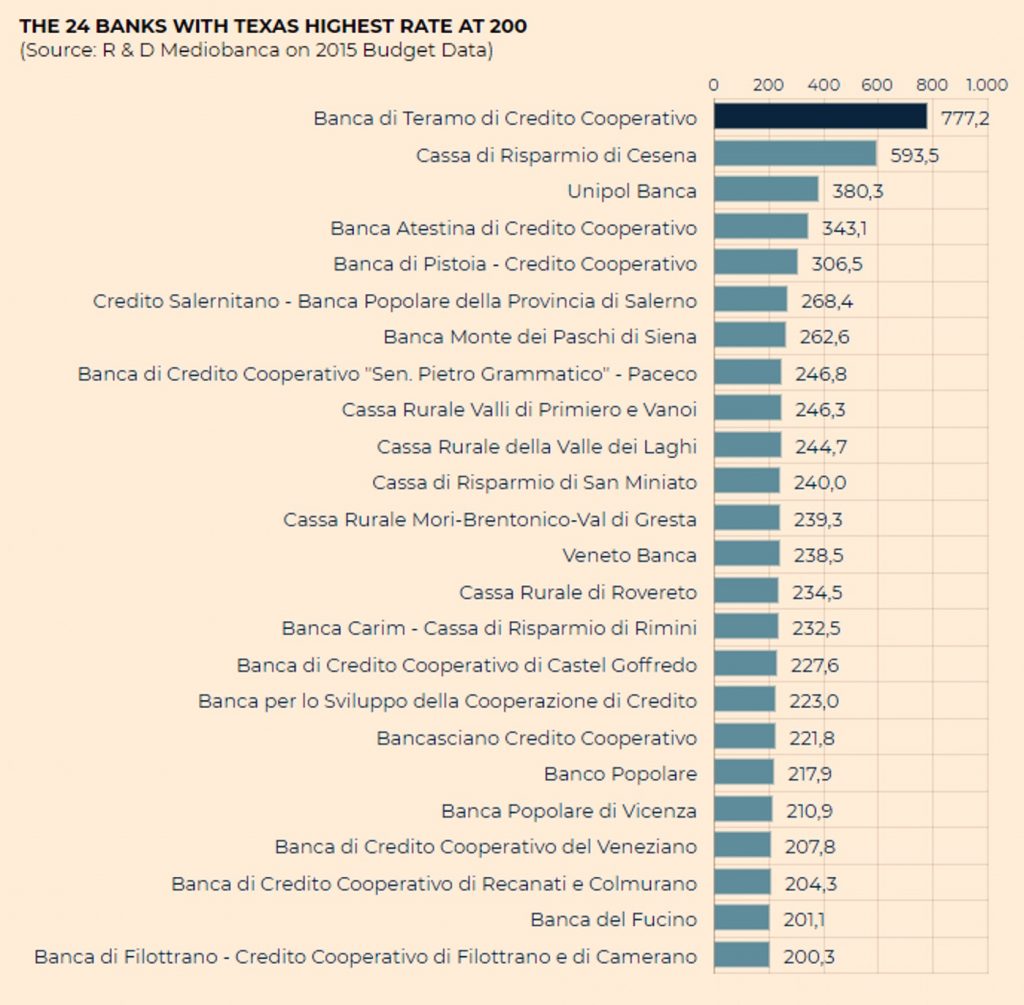

Source: ilsole24ore.com

Another week and another unjustifiable move by the ECB to 'protect' the EU's banking system. This time it is the decision to toughen bad-loan rules for euro-area banks.

The rules state that banks must be held to firm deadlines for writing down loans that turn sour. Banks will be required to provision fully for loans that turn sour from the start 2018.

This is particularly bad news for Italy. The country has over €318 billion of bad loans. Should the banks be forced to dispose of these non-performing loans too quickly then a financial disaster could be triggered, derailing any form of recovery

This is a step too far for Italy's bankers who argued the ECB had overstepped its supervisory role, instead enforcing measures that should only be enforced by lawmakers.

Should they be enforced these new measures will not only put extra pressure on smaller banks but result in yet more savers and businesses losing money. The idea that these new policies will be beneficial for all is arguably laughable. Especially when one looks at the overall state of the Italian banking system.

The Texan warning signal

The health of a bank's non-performing loans (NPLs) can be measured using the Texas ratio. This is a measure of bad loans as a proportion of capital reserves. When the reading is over 100 it is a warning signal the banks need a solution quickly.

Data cited in a March 2017 article shows that 23% of Italy's near 500 banks are showing signs of severe stress. 24 of the banks that have a Texas ratio reading of over 200.

The bureaucrats in the likes of the ECB aren't worried about the majority of the Italian banks with a Texas ratio of over 100 as they are small local or regional savings banks with tens or hundreds of millions of euros in assets. But when a reading of over 100 basically means they don't have enough money to pay for the bad loans, what happens to the people who have their money with these small banks?

This isn't just about those with money in small banks. The larger banks that often prop up the system are also in bad shape:

- Banco Popolare (the result of a merger between Banco Popolare di Verona e Novara and Banca Popolare Italiana in 2017 and then a subsequent merger with Banca Popolare di Milano on 1 January 2017): €120 billion in assets; TR: 217%.

- UBI Banca: €117 billion in assets; TR: 117%

- Banca Nazionale del Lavoro: €77 billion in assets; TR: 113%

- Banco Popolare Dell’ Emilia Romagna: €61 billion in assets; TR: 140%

- Banca Carige: €30 billion in assets; TR: 165%

- Unipol Banca: €11 billion in assets; TR: 380%

i.e. with the exception of Unicredit (TR of 90%), Intesa Sao Paolo (TR of 90%) and Mediobanca all of Italy's major banks have TR ratios of over 100.

As long as these banks continue to have worsening TR ratios then Italy's banking system has little hope of finding its feet again. In turn, this means more of Italy's savers, pensioners and businesses will suffer.

If you want help, ransack savings first

We all remember Cyprus in 2013. When savers went to their bank accounts to find their money gone thanks to ECB policy. Uproar was short-lived as the rest of Europe believed this wasn't something that could happen to them. They remained arrogant when the ECB brought in official bail-in policies, which would see savers impacted even more should a bank begin to fail.

Sadly this is not something Italy can ignore.

If anywhere has felt the brunt of the ECB's bank 'rescue' proposals then it is Italy that has been hit the hardest. Sadly it is set to happen time and time again.

[image]https://www.goldcore.com/ie/wp-content/uploads/sites/19/2017/12/1400x-1-2-1024x576.png[/image]

Already this year the EU has seen four bank 'rescues', three in Italy thanks to the NPL market: Monte dei Paschi, Banca Veneto and Vicenza Banca in Italy and Banco Popular in Spain.

Each of them were crushed by the weight of NPLs on their balance sheets and insufficient capital to offset higher losses. Who suffered? Bank creditors, i.e. savers.

Andrew Fraser, Head of Financial Research (Credit) at Standard Life Investments, explained:

In each case, the outcome for subordinated bondholders was very negative, with falling prices reflecting the likelihood of zero recovery on an investment.

“The failures have also raised questions as to whether there is sufficient clarity in the application of the regulatory rulebook.

“The risk of owning bank debt has increased materially. Investors more than ever need to fully understand the risks embedded in a bank’s balance sheet but also the thickness of each layer of a bank’s capital structure which could absorb losses in the event of distress.”

In order to 'help' the Italian banking system the ECB will no doubt end up doling out charitable lending (formally known as TLTRO II). But, banks don't qualify so easily for public financing, without the help of their generous customer first.

Zerohedge explains:

In order to qualify for public assistance, banks must be solvent. Presumably, that would automatically disqualify any bank with a Texas Ratio of over 150%, which includes MPS, Banco Popolare, Popolare di Vicenza, Veneto Banca, Banca Carige and Unipol Banca. The bailout must also comply with current EU regulations including the Bank Recovery and Resolution Directive of Jan 1, 2016, which specifically mandates that before public funds are injected into a bank, shareholders and creditors must be bailed in for a minimum amount of 8% of total liabilities, as famously happened in the rescue of Cyprus’ banking system in 2013.

Savers suffer as banks fail

As we have written about previously EU banking regulations do not protect those who need protection - savers, pensioners and businesses.

It seems every few months there are new measures announced to further prop up the banking system. With each one is further punishment and risk for those with cash or investments in the banks.

At the beginning of November we broke the news that new ECB proposals outlined plans to remove the deposit protection scheme. The news was little reported in the mainstream media, demonstrating the lack of concern readers currently have for the safety of their money.

Italy has a lesson to teach us all, not about how to support a banking system but how to protect your savings from EU bureaucrats.

Policies from the EU's legislators and bankers are created with one purpose in mind: keep the Eurozone afloat. To do this, they believe, individuals must make sacrifices through their savings, their pensions and even their homes.

This does not mean that those with money and investments in the bank must take the same approach. For some ignorance is bliss, for others the deposit protection insurance is enough of a safety net. However depositors and investors should be aware of the policies when it comes to keeping their money safe in the banking system. Whilst bail-ins will at present only hurt those who hold deposits above EUR 100,000, there is little stopping the protected amount being decreased, or ignored altogether.

The European Commission has forced all 28 countries to implement bail-in legislation, something anyone with exposure to an EU bank must be aware of. Consider the health of a particular bank and the risk exposure of their portfolio. This means diversifying your invesments and decreasing your own level of counterparty exposure.

Protect your savings, not your bank

Gold investment is seeing an uptick as a result of concerns surrounding counterparty risk. Gold investment saw a 15% climb in Q2 of 2016. Europe, in 2015, showed the largest regional demand for gold bars and coins (an increase of 12% year on year).

Do not believe that any gold investment will protect you. Unallocated gold is as much exposed to counterparties as any other bank-based asset. Wealth of individuals and businesses can by protected by investing in allocated gold, held in segregated accounts. The buyer has legal ownership, with no counterparties to pop along after going bust and take what is legally theirs. Allocated gold held in segregated accounts cannot disappear overnight.

Gold is the financial insurance against bail-ins, political mismanagement and overreaching government bodies.

[image]https://www.goldcore.com/ie/wp-content/uploads/sites/19/2017/10/bail-ins-considerations.png[/image]

Related reading

Bail-Ins In Italy? World’s Oldest Bank “Survival Rests On Savers”

Protect Your Savings With Gold: ECB Propose End To Deposit Protection

Invest In Gold To Defend Against Bail-ins

News and Commentary

Asia Stocks Mixed, Dollar Falls as Tax Boost Fades (Bloomberg.com)

Dollar stalls as next step in US tax reform awaited (Reuters.com)

Gold ends lower as tax-cut progress lifts U.S. dollar, stocks (MarketWatch.com)

Gold ETFs Soar as Russia Probe Closes In on Trump’s Inner Circle (Bloomberg.com)

U.S. Stock Rally Fizzles as Tech Drops, Oil Slumps (Bloomberg.com)

[image]https://www.goldcore.com/ie/wp-content/uploads/sites/19/2017/12/resilient-pound-top-three.png[/image]Source: Bloomberg

People have spent over $1 million buying virtual cats on ethereum blockchain (TechCrunch.com)

Russia-China bond market play could start a dollarless financial system (RT.com`)

World Gold Council plans another ETF (ETF.com)

The War On Gold Intensifies: It Betrays The Elitists' Panic And Coming Defeat (ZeroHedge.com)

The Pound is Enjoying a Fresh Wave of Confidence From Investors (Bloomberg.com)

Gold Prices (LBMA AM)

05 Dec: USD 1,275.90, GBP 950.29 & EUR 1,075.71 per ounce04 Dec: USD 1,279.10, GBP 952.67 & EUR 1,079.43 per ounce01 Dec: USD 1,277.25, GBP 946.57 & EUR 1,072.51 per ounce30 Nov: USD 1,282.15, GBP 952.64 & EUR 1,084.06 per ounce29 Nov: USD 1,294.85, GBP 965.70 & EUR 1,092.46 per ounce28 Nov: USD 1,293.90, GBP 972.75 & EUR 1,088.95 per ounce27 Nov: USD 1,294.70, GBP 969.73 & EUR 1,084.83 per ounce

Silver Prices (LBMA)

05 Dec: USD 16.29, GBP 12.14 & EUR 13.72 per ounce04 Dec: USD 16.33, GBP 12.09 & EUR 13.77 per ounce01 Dec: USD 16.42, GBP 12.16 & EUR 13.80 per ounce30 Nov: USD 16.57, GBP 12.32 & EUR 14.00 per ounce29 Nov: USD 16.90, GBP 12.60 & EUR 14.26 per ounce28 Nov: USD 17.07, GBP 12.84 & EUR 14.36 per ounce27 Nov: USD 17.10, GBP 12.81 & EUR 14.32 per ounce

Recent Market Updates

- Silver’s Positive Fundamentals Due To Strong Demand In Key Growth Industries- An Interview with GoldCore Founder, Mark O’Byrne- Risk Of Online Accounts Seen As One of Largest Brokerages In World Halts Online Trading After “Glitch”- Low Cost Gold In The Age Of QE, AI, Trump and War- Own Gold Bullion To “Support National Security” – Russian Central Bank- Bitcoin $10,000 – Huge Volatility of Cryptocurrencies and Risky Fiat Making Gold Attractive- Financial Advice from Dr Wayne Dyer- Buy Gold As Fed Shows Uncertainty And Concern Over Financial ‘Imbalances’- Brexit Budget – Grim Outlook As UK Economy Downgraded- Geopolitical Risk Highest “In Four Decades” – Gold Demand in Germany and Globally to Remain Robust- Gold Versus Bitcoin: The Pro-Gold Argument Takes Shape- Money and Markets Infographic Shows Silver Most Undervalued Asset- Is New Fed Chief A “Swamp Critter Extraordinaire”?

Important Guides

For your perusal, below are our most popular guides in 2017:

Essential Guide To Storing Gold In Switzerland

Essential Guide To Storing Gold In Singapore

Essential Guide to Tax Free Gold Sovereigns (UK)

Please share our research with family, friends and colleagues who you think would benefit from being informed by it.