![]()

See this visualization first on the Voronoi app.

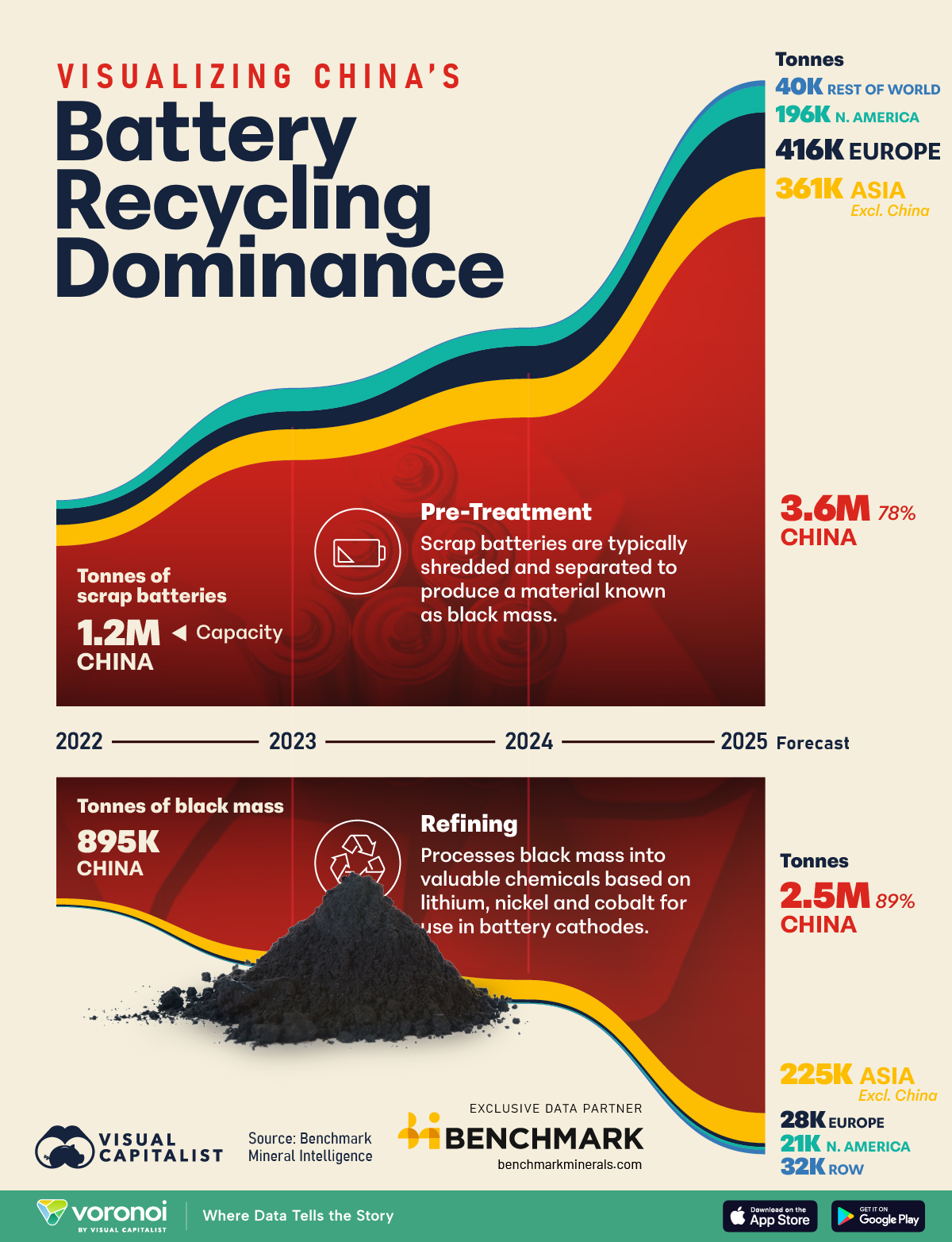

Visualizing China’s Battery Recycling Dominance

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

Battery recycling is expected to become a cornerstone of the global energy transition as electric vehicles (EVs) and other battery-powered technologies become more widespread.

According to exclusive data from Benchmark Mineral Intelligence, China holds a dominant position in both the pre-treatment and refining stages of battery recycling.

Chinese Growing Dominance

Battery recycling involves two major stages. First is pre-treatment, where recycling begins. Scrap batteries are typically shredded and separated to produce a material known as black mass.

The next stage is refining, which processes black mass into valuable lithium-, nickel-, and cobalt-based chemicals for use in battery cathodes.

China’s scale, infrastructure, and early investments in battery supply chains have translated into an outsized advantage in recycling capacity.

The country is expected to process 3.6 million tonnes of scrap batteries in 2025, up from 1.2 million tonnes in 2022. This would account for 78% of global pre-treatment capacity, with total global capacity projected to exceed 4.6 million tonnes.

| Region/Tonnes | 2022 | 2023 | 2024 | 2025P |

|---|---|---|---|---|

| Global | 1.5M | 2.4M | 2.8M | 4.6M |

| China | 1.2M | 1.8M | 2.1M | 3.6M |

| Asia excl. China | 158K | 231K | 288K | 361K |

| Europe | 118K | 133K | 243K | 416K |

| North America | 59K | 165K | 129K | 196K |

| ROW | 4K | 6K | 6K | 40K |

In second place is the rest of Asia, with 361,000 tonnes, followed by Europe with 416,000 tonnes. While the U.S. attempts to reduce its reliance on China in the mineral sector, North America accounts for just 196,000 tonnes.

The refining stage is even more concentrated.

China’s black mass refining capacity is projected to nearly triple, from 895,000 tonnes in 2022 to 2.5 million tonnes by 2025—representing 89% of global capacity.

| Region/Tonnes | 2022 | 2023 | 2024 | 2025P |

|---|---|---|---|---|

| Global | 960K | 1.4M | 1.7M | 2.8M |

| China | 895K | 1.3M | 1.5M | 2.5M |

| Asia excl. China | 48K | 101K | 146K | 225K |

| Europe | 13K | 23K | 25K | 28K |

| North America | 4K | 5K | 5K | 21K |

| ROW | 0 | 1K | 1K | 32K |

Refining is critical, as it converts recycled material into high-purity, battery-grade chemicals. The rest of Asia is expected to refine 225,000 tonnes, Europe 28,000 tonnes, and North America only 21,000 tonnes. Between 2022 and 2025, China’s refining capacity is projected to grow by 179%, while North America’s is expected to surge by 425%—albeit from a much smaller base.

As global demand for EVs and battery storage rises, countries looking to build domestic recycling infrastructure must accelerate investment to reduce dependence on Chinese supply chains.

Learn More on the Voronoi App ![]()

If you enjoyed this post, be sure to check out this graphic, which forecasts the number of mines that must be developed to meet the expected demand for energy transition raw materials and chemicals by 2030.