Published

2 hours ago

on

September 16, 2025

| 34 views

-->

By

Julia Wendling

Graphics & Design

- Athul Alexander

The following content is sponsored by Tema ETFs

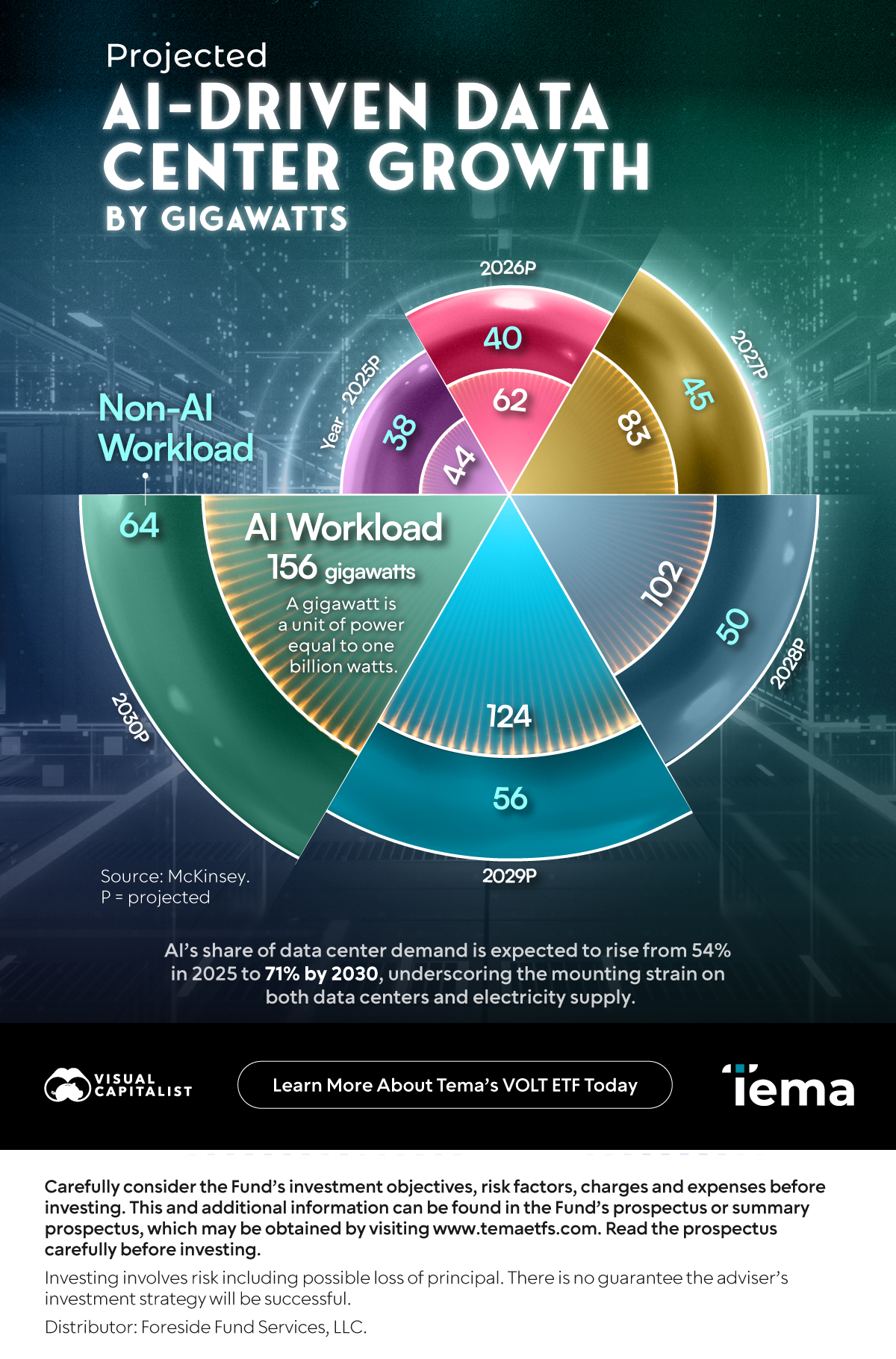

Projected AI-Driven Data Center Growth

The rise of Artificial Intelligence (AI) brings enormous benefits, but it also presents challenges—chief among them is the technology’s heavy electricity use.

In partnership with Tema ETFs and the second post in VOLTage week, this visualization highlights how AI is projected to drive growing electricity demand in the years ahead, using data from McKinsey.

AI & Electricity Use

Artificial intelligence consumes a lot of electricity for several reasons. Training a model requires processing massive datasets, which demands huge amounts of computing power. The more complex the model, the more energy it takes to run.

Even after training, energy use continues. Every time an AI answers a query—a process called inference—it requires graphics processing unit (GPU) power, adding significantly to energy demand.

Data Centers

Artificial intelligence needs data centers because the models are too large and complex to run on ordinary computers. Data centers provide the specialized GPUs, storage, and networking required for model training and inference. All of this hardware consumes large amounts of electricity to function.

On top of that, cooling systems are needed to keep servers from overheating, which adds even more power use. As AI adoption grows, so does the electricity demand tied to expanding data center capacity.

AI’s Growing Share of Data Center Capacity

In 2025, artificial intelligence is already projected to consume more data center capacity than all other workloads combined—44 gigawatts versus 38 gigawatts. That gives AI a 54% share of total capacity.

| Year | AI (gigawatts) | Non-AI (gigawatts) | AI Share |

|---|---|---|---|

| 2025P | 44 | 38 | 53.7% |

| 2026P | 62 | 40 | 60.8% |

| 2027P | 83 | 45 | 64.8% |

| 2028P | 102 | 50 | 67.1% |

| 2029P | 124 | 56 | 68.9% |

| 2030P | 156 | 64 | 70.9% |

Looking ahead, the shift becomes even more dramatic. By 2030, demand from artificial intelligence workloads is expected to reach 156 gigawatts, compared to 64 gigawatts for non-AI uses. At that point, AI would account for nearly 71% of all data center demand.

Looking Ahead

Electricity demand is set to climb steadily as AI adoption accelerates and data centers expand. This structural growth could create a powerful tailwind for companies involved in power generation, grid infrastructure, and energy technologies. For investors, the sector could offer a compelling long-term opportunity to capitalize on the digital and energy transitions shaping the future.

The Tema Electrification ETF (VOLT) invests in the companies powering the future—from energy generation to grid modernization and power management technologies. Electrify your portfolio.

Learn more about VOLT.

Source: McKinsey (2024)

Carefully consider the Fund’s investment objectives, risk factors, charges and expenses before investing. This and additional information can be found in the Fund’s prospectus or summary prospectus, which may be obtained by visiting www.temaetfs.com. Read the prospectus carefully before investing

Investing involves risk including possible loss of principal. There is no guarantee the adviser’s investment strategy will be successful.

Distributor: Foreside Fund Services, LLC.

More from Tema ETFs

-

Energy1 day ago

U.S. Electricity Demand by Source (2024-2050)

Electricity demand is set to soar in the coming decades. Which sources are likely to be responsible for this surge?

-

Economy2 months ago

Ranked: U.S. States Gaining the Most Jobs from Reshoring

As the reshoring trend accelerates, millions of manufacturing jobs are returning to American soil. But the benefits aren’t being shared equally across the country.

-

Economy3 months ago

Visualized: Reshoring Investments in the U.S. Have Surged to $1.7T

Reshoring began with supply chain disruptions and sluggish job growth—now it’s gaining momentum with the White House.

-

Markets4 months ago

Ranked: 2025’s 10 Largest S&P 500 Stocks

When you invest in S&P 500 stocks, you’re gaining exposure to the 500 biggest publicly traded companies in the U.S.—but not equally.

-

Economy4 months ago

Ranked: America’s $425B Trade Deficit by Product

See which goods drive America’s $425B trade deficit—and why they signal key opportunities for U.S. reshoring and domestic investment.

-

Markets4 months ago

Visualized: The Rising Concentration of the S&P 500

By early 2025, the top ten companies in the S&P 500 made up nearly 40%, marking a high degree of market concentration.

-

Markets4 months ago

The Surging Value of the Magnificent 7 Versus the S&P 500 (2014-2024)

The Magnificent 7 stocks have soared from $1.8T in 2014 to over $18T by 2024—but is their growing dominance making the S&P 500 concentrated?

Subscribe

Please enable JavaScript in your browser to complete this form.Join the 375,000+ subscribers who receive our daily email *Sign Up