![]()

See more visualizations like this on the Voronoi app.

Use This Visualization

Visualizing How Much Gold Is Left to Mine on Earth

See visuals like this from many other data creators on our Voronoi app. Download it for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

Key Takeaways

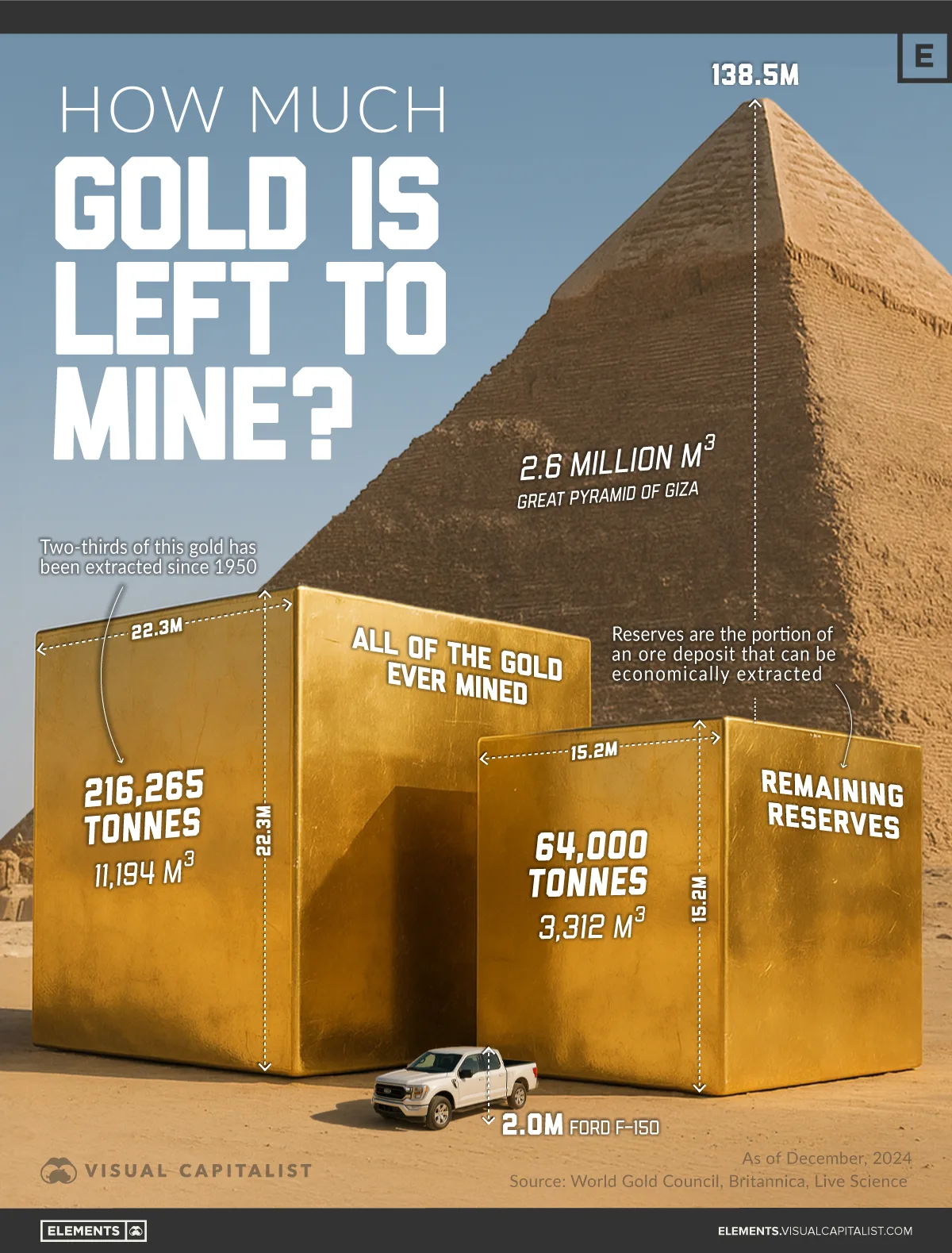

- Roughly 216,000 tonnes of gold have been mined, with about 64,000 tonnes of reserves left underground.

- Gold prices have surged more than 50% in 2025 amid global economic uncertainty and rising investor demand.

Gold’s scarcity is one reason it remains a sought-after safe haven. In 2025, the metal has seen its strongest rally in years, climbing over 50% as global investors react to uncertainty in the world economy.

If all the gold ever mined were melted together—about 216,000 tonnes—it would form a cube only 22 meters tall, roughly the height of a four-story building.

Meanwhile, the world’s proven, economically recoverable gold reserves total around 64,000 tonnes, forming a smaller 15-meter cube.

In this infographic, we use data from the World Gold Council and the U.S. Geological Survey (USGS), with additional historical context from Encyclopaedia Britannica, to put the total quantity of gold into perspective.

How Much Gold Exists—and How Much Is Left

Nearly three-quarters of all known gold has already been extracted. As new discoveries become rarer and mining costs rise, the focus increasingly shifts to recycling and improving recovery technology.

| Category | Gold (tonnes) | Cube Side (m) |

|---|---|---|

| Already mined | 216,265 | 22.3 m |

| Remaining reserves | 64,000 | 15.2 m |

The Modern Era Drove Most Extraction

Two-thirds of all gold ever mined has been extracted since 1950, thanks to technological advances and industrial demand. The post-war era ushered in large-scale open-pit mines and efficient refining techniques. Today, extraction rates are slowing as ore grades decline, but the overall above-ground stock continues to grow slowly each year.

Of all gold mined, about 45% exists as jewelry, while 22% is held as bars and coins. Central banks collectively own about 17%, using gold as a strategic hedge against inflation and geopolitical instability. Gold is also use in technology and other industries, powering electronics and aerospace components.

Gold’s Rally in 2025

Gold prices hit $4,000 for the first time ever in 2025, as investors sought a safe haven from a weaker dollar, geopolitical volatility, and economic uncertainty.

At the same time, China and other countries have been diversifying away from U.S. Treasuries and into gold, following Washington’s stiff sanctions on Russia after its 2022 invasion of Ukraine. Retail investors have also piled into gold as a hedge against stubborn inflation.

Can More Gold Be Found?

Although economic gold reserves in the ground sit at around 64,000 tonnes, this doesn’t count all the gold left.

There are more undiscovered gold deposits out there, and as the price of gold rises, smaller or low-grade deposits become more economically feasible to mine. High prices also create the incentive for explorers to look for more gold, which leads to new discoveries.

Learn More on the Voronoi App ![]()

If you enjoyed today’s post, check out Ranked: The 5 Largest Gold Producing Countries (2010–2024) on Voronoi, the new app from Visual Capitalist.