Growth In China Is Slowing: What Does It Mean For Commodity Prices

By Gordon Johnson of Axiom Capital

CHINA MACRO ANALYSIS: Growth in China is Slowing... Will it Continue, and What, if Any, will be the Impact to Commodity Prices?

By Gordon Johnson of Axiom Capital

CHINA MACRO ANALYSIS: Growth in China is Slowing... Will it Continue, and What, if Any, will be the Impact to Commodity Prices?

Submitted by Pater Tenebrarum via Acting-Man.com,

Victims of the Boom-Bust Cycle

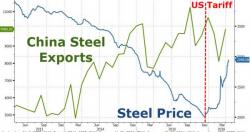

The world is drowning in steel – there is huge overcapacity in steel production worldwide. This is a direct result of the massive global credit expansion that has taken place over the past 15 years. Much of this capacity is located in China, but while the times were good, iron ore and steel production (and associated lines of production) was expanded everywhere else in the world as well.

Steel factory

A funny thing happened when US slapped a major tariff on China's steel exports... prices exploded higher. But the almost 50% surge in steel prices since mid-December back to 15-month highs have left traders equally split on what happens next.

Goldman does it again.

Just hours after the central banker-spawning investment bank issued a report in which it said the iron ore rally is likely to be short lived "in the absence of a material increase in Chinese steel demand, and steel raw materials will once again drive steel prices rather than the other way around", overnight Iron Ore futures traded on the Singapore SGX exploded as much as 19% higher to $58.95 in one session.