Global Stocks, US Futures Slide Spooked By G20 Protectionist Shift; Dollar Drops For 4th Day

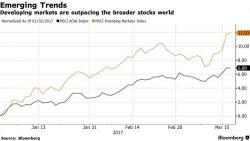

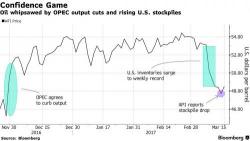

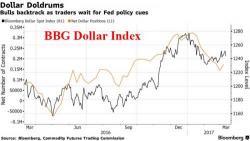

Global markets start the week mixed with Asian stocks rising (Japan was closed for holiday), European stocks sliding, weighed down by declines in oil-and-gas shares and banks, and S&P500 futures also down. The dollar fell to a six-week low, falling four days in a row for the first time since early November as G20 leaders scrap a long-standing commitment to reject all forms of trade protectionism, suggesting the "weak Dollar" camp in Trump's inner circle is winning.