Futures, Dollar Slide; European Stocks At 3-Week Lows As "Trump Reality Sets In"

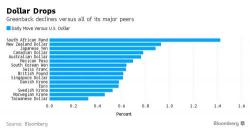

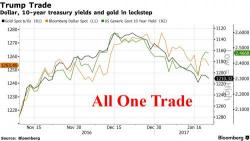

While US stocks closed near session, and all time highs on Friday, the first green close on inauguration day in over 50 years, Monday has seen a modest case of buyer's remorse, with European stocks sliding, Asian shares mixed and U.S.