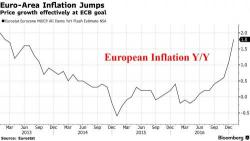

Futures Fall On Rising Trump Uncertainty; Europe Stocks Rise As Euro-Area Inflation Surges

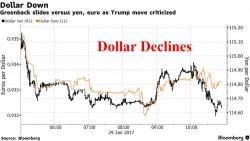

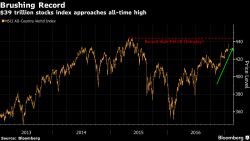

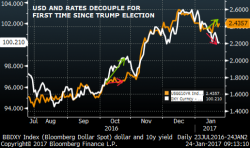

European bonds fell and stocks rose led by banks and retailers as surging inflation data prompted investors to switch into reflationary assets even as speculation about ECB tapering has returned. Asian stocks and US equity futures declined. The Yen and gold advanced after Trump’s firing of the U.S. acting attorney general added to concern over the unpredictability of decisions in the new administration.