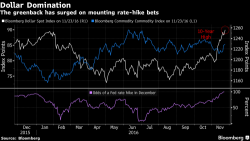

Relentless Dollar Surge Continues: Asian Currencies Plunge To 7 Year Lows, Hitting Emerging Markets

While most global equity markets were subdued due to the US Thaksgiving holiday, the FX world was very busy overnight, marked by the relentless dollar surge on expectations of a rate hike not only in December but further in 2017, sending Asian currencies to the weakest level in 7 years: the Bloomberg-JPMorgan Asia Dollar Index reached 103.32, the lowest level since March 2009.