Bill Gross Trolls "Addled, Impotent" Central Bankers, Asks "How's It Workin' For Ya?"

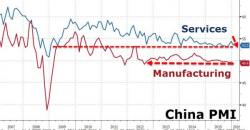

It's no secret that trillions in global QE and the descent into the NIRP twilight zone have done very little to resuscitate global growth and trade in the wake of the crisis.

Indeed, eight years on and the world is mired in subpar growth and faces a global deflationary supply glut that's driven commodity prices to their lowest levels of the twenty-first century on the way to undercutting central bankers' collective efforts to jumpstart inflation and keep the entire world from becoming Japanified.