Euro Tumbles; Stocks, Futures Surge After Draghi Says ECB "Will Reconsider Policy Stance In March"

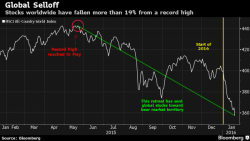

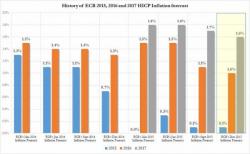

Back in September, Draghi set the stage for the unleashing of an imminent QE bazooka, something the market was fully convinced would take place on December 3, pushing the EUR lower by nearly 10 big figures and pushing European stocks to nosebleed levels. When it didn't, and when Draghi unveiled a water pistol instead, the EUR soared by a near record amount, and Euro assets crashed.

Fast forward to today, when as we previewed earlier today, nobody was expecting much if anything from Draghi, to wit: