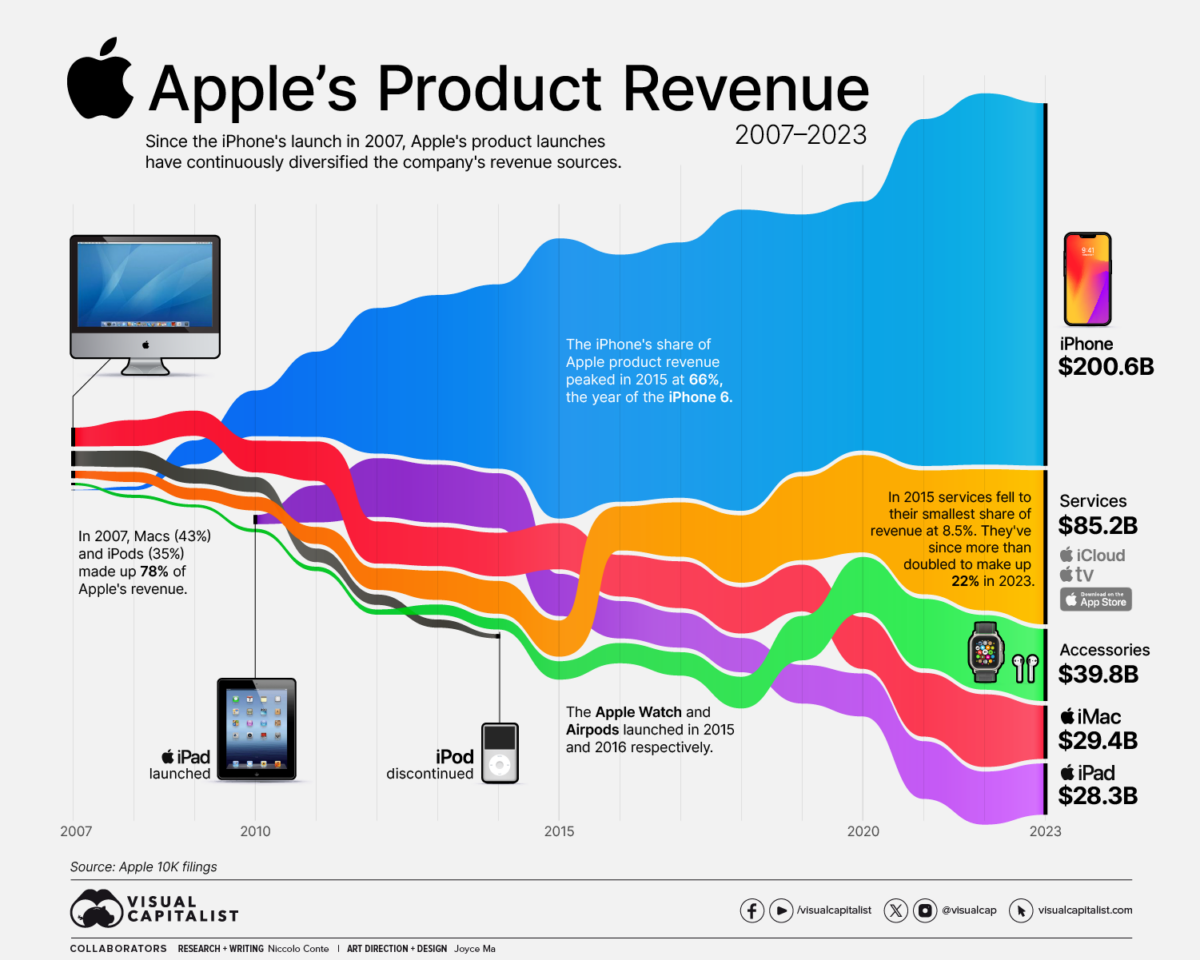

Charted: Apple’s Product Revenue (2007-2023)

![]()

See this visualization first on the Voronoi app.

Charted: Apple’s Product Revenue (2007-2023)

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.