Greek, Italian Risks Weigh On European, Global Markets; Oil, Gold Slide

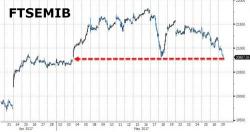

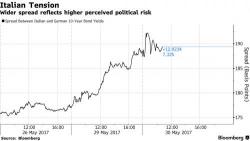

Tuesday's session started off on the back foot, with the Euro first sliding on Draghi's dovish comments before Europarliament on Monday where he signaled no imminent change to ECB’s forward guidance coupled with a Bild report late on Monday according to which Greece was prepared to forego its next debt payment if not relief is offered by creditors, pushing European stocks lower as much as -0.6%. However the initial weakness reversed after Greece's Tzanakopoulos denied the Bild report, sending the Euro and European bank stocks higher from session lows.