Futures Flat As Payrolls Loom, Dollar Slide Continues

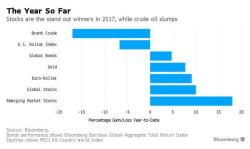

It took stocks only a few minute to "price in" the latest political shock out of Washington, and as of this morning Emini futures no longer care that Mueller has a grand jury, trading 0.08% in the green with European stocks and Asian shares all little changed as investors await the looming July jobs report, which is expected to show a slowdown in hiring from 222K to 180K but will have little impact on either the Fed's thinking or the market.