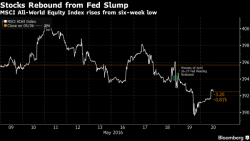

Risk On: 2017 Stock Rally Continues As Global Inflation Accelerates

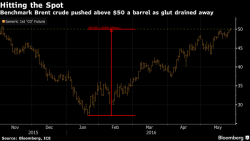

Following another day of upbeat economic data, with growing signs that inflation on both sides of the Atlantic is accelerating, investors rediscovered their faith in the Trumpflation rally, pushing global stocks and US equity futures higher, fuelling a second day of 2017 equity gains ahead of today's release of the Fed's December minutes.