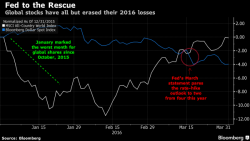

Global Stocks Plunge After Bank Of Japan "Shock"

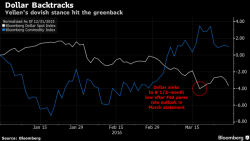

It is very fitting that on today's April 28th anniversary of the bull market, the day that officially makes this the second-longest "bull market" in history, the market got a stark reminder of just how it got there: through constant and relentless central bank intervention, which has been "beneficial" to stocks for the most part, however last night was anything but.