Yield Curve Inverts, Yuan Slides As China GDP Growth Slows

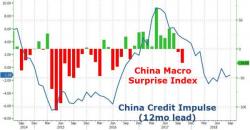

Despite all the talk of deleveraging, China did anything but according to its most recent data but the lagged impact of the tumbling credit impulse is starting to show up in the broader macro data. Despite the National Congress being under way (and recent credit spikes and positive PBOC hints) GDP growth limped lower to the expected +6.8% YoY, and fixed asset investment growth was the weakest in over 17 years...