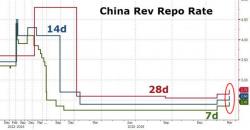

Why China Unexpectedly Hiked Rates 10 Hours After The Fed

As we reported on Wednesday evening, something interesting took place on Thursday morning in Beijing: in a case of eerie coordination, China tightened monetary conditions across many of the PBOC's liquidity-providing conduits just 10 hours after the Fed raised its own interest rate by 0.25% for only the third time in a decade.