Axel Merk's 2018 Outlook: "What Can Possibly Go Wrong?"

Authored by Axel Merk via MerkInvestments.com,

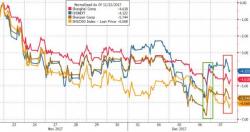

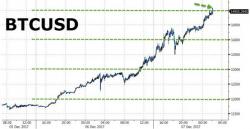

With the stock market and Bitcoin reaching all-time highs, what can possibly go wrong? In offering my thoughts on 2018, I see my role in reminding investors to stress test their portfolios. Is your portfolio built of straw, sticks or brick?

First, let me allege many investors have portfolios built of straw and sticks rather than brick. How do I know this? Here’s a brief check: