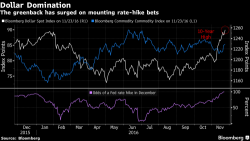

Risk Parity Funds Suffer Worst Month Since 2015 As Breadthless, Fearless Stock Market Soars

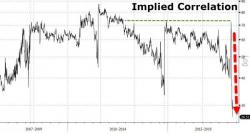

The market moves since the US elections have been both big and surprising, and as JPMorgan notes, fund managers have been either too slow or too reluctant to jump into the Trump trade. However, algo-based Risk-Parity funds suffered the most with their biggest loss since Dec 2015 as market 'fear' tumbles to 9 month lows (and stocks are the most overbought in 13 years).