Soros Returns To Trading With "Big, Bearish" Bets On Economic Turmoil

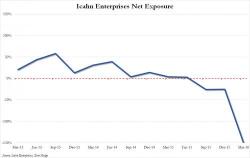

One month ago, we were stunned to report that none other than billionaire Carl Icahn had taken the net exposure of his hedge fund, Icahn Enterprises, from a modest net 25% short - his recent negative bias on the market was hardly a secret - to a practically apocalyptic, 149% net short which is about as close to betting on a market crash as one could get.