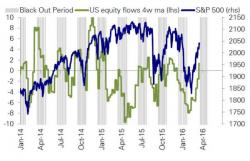

Buyback Blackout Period Starts Monday: Is This The Catalyst That Ends The S&P Rally?

Last week, one day before the Fed unleashed a statement that stunned Wall Street by its dovishness and admission that the Fed had been far too optimistic on the state of the US (and global) economy, when it slashed its forecast on the number of rate hikes from 4 to 2, we said that "while everyone's attention is on the Fed, the biggest danger to the S&P500 has little to do with what Janet Yellen may say tomorrow, and everything to do with the marginal buyer of stocks being put into a state of forced hibernation", namely the start of the stock buyback blackout period during Q1 earnings se