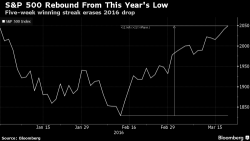

It's Day 26 Of The Rally - Decision Time

In September/October 2015, the S&P 500 miraculously rallied just over 13% in 25 days amid falling earnings expectations, before collapsing back to fresh cycle lows. It has now been 25 days (and just over 13%) since the Mid-Feb lows (and earnings expectations are plumbing new lows)...

The same but different?

h/t @ErikFridman

Nope - the same!?

Trade accordingly.