Is This Why Stocks Are Suddenly Surging: NY Fed Cancels Today's POMO Due To "Technical Difficulties"

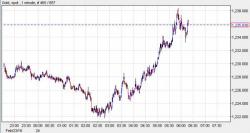

Just at the market began its torrid ramp higher today at 11:15 am on the dot, something else was expected to happen: the Fed's open market buying, or POMO, of Agency MBS (yes, those still continue despite the end of QE because the Fed has to keep the level of its balance sheet flat and offset maturities).

Only today this did not happen. Instead, this is what the NY Fed said:

Wed, February, 24, 2016