Bear Market Rallies & Bailing-Out Bad Behavior

Submitted by Lance Roberts via RealInvestmentAdvice.com,

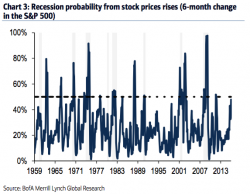

Biggest Rallies Occur In Bear Markets

As expected, the market was oversold enough going into last Friday to elicit a short-term reflexive bounce. Not surprisingly, it wasn’t long before the “bulls” jumped back in proclaiming the correction was over.

If it were only that simple.