Authord by Kevin Muir via The Macro Tourist,

I am aware of all the doomsday Yen hyper-inflationary predictions due to their soaring debt-to-GDP ratio. And these Japanese bears very well might prove correct… In the long run.

But as Mr. Keynes taught us, the long-run is an awfully long time. In the meantime, I think there is a terrific opportunity in Japanese assets, and that also includes the currency.

This flies in the face of most market pundits’ forecasts. You will often hear recommendations to buy Japanese equities, but they will often be couched with warnings that it needs to be done on a “currency hedged basis.” And it’s easy to see why.

BoJ Balance Sheet Expansion

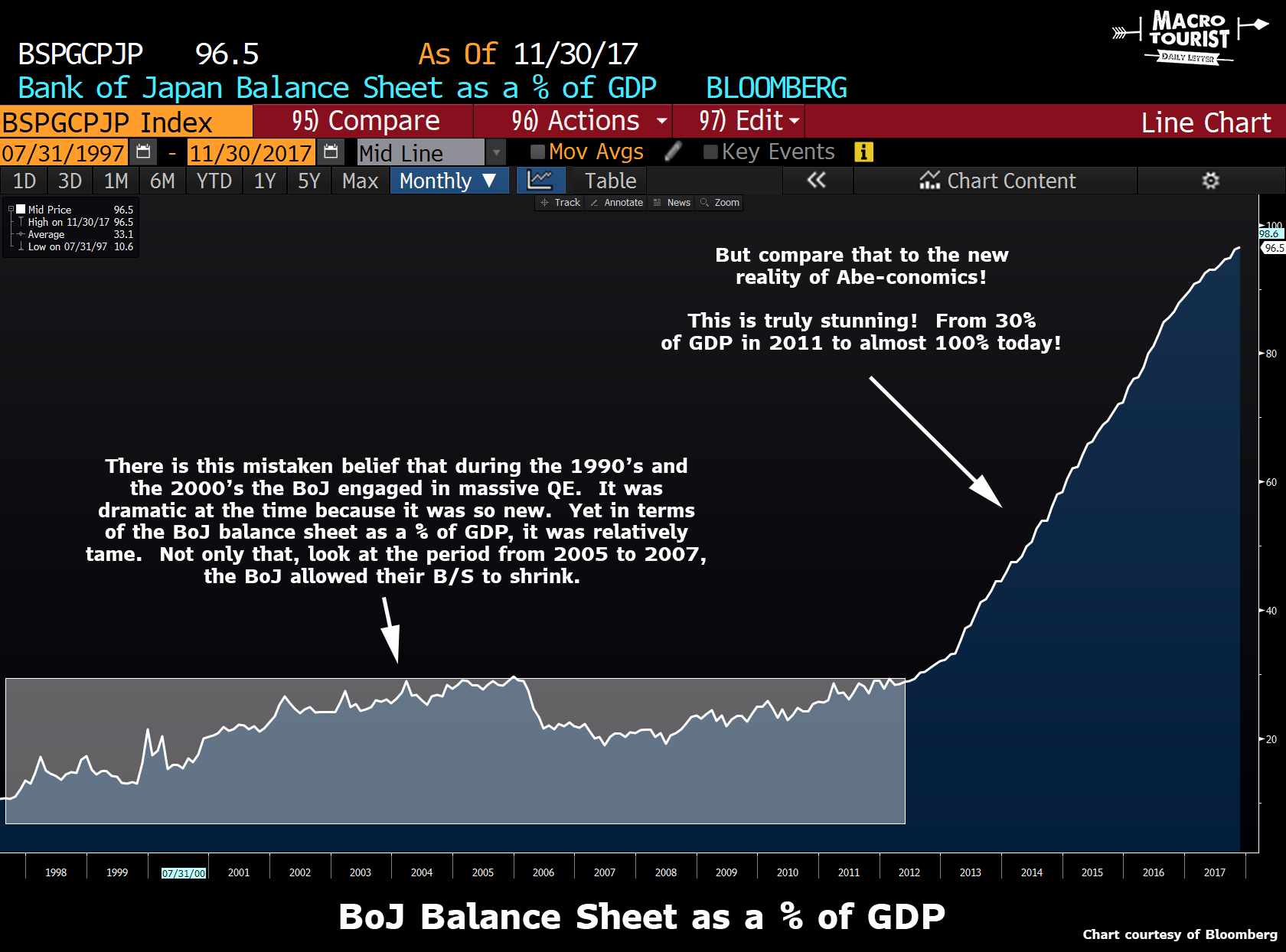

Over the past half-dozen years, the BoJ has gone fully bat-shit crazy with balance sheet expansion. It’s unprecedented in modern economic times. Yet many believe this to be the final stage in what has been two decades of insane monetary policy.

Contrary to most conventional wisdom, the BoJ’s quantitative easing programs in the late 1990’s and 2000’s was not nearly as dramatic as many pundits remember. It seemed frightening at the time, but that was because Japan was the only country stuck at the zero bound and forced to expand their balance sheet.

The moment the economy seemed ready to finally spark, the Japanese government pulled back on both the monetary and fiscal stimulus, worried that, much like an engine with the choke on, they would flood it. Well, this proved disastrous and the result was that the economic engine never fully started.

You might disagree with that assessment, so be it. It doesn’t really matter. Although, it took almost two decades, eventually the Japanese people came to this conclusion and elected Prime Minister Abe, largely on his dramatic economic reform platform.

As you will notice, the BoJ is no longer making the mistake of closing the choke at the first engine turn that catches. The BoJ has taken their balance sheet from 30% in 2011 to almost 100% today. That’s an insane amount of stimulus.

So there is little wonder that most forecasters are extremely wary of being long a currency whose supply has been increased so dramatically.

For the first couple of years of Abeconomics, the Yen did weaken. Materially. The USDJPY rate went from 75 to 125.

And this currency devaluation drove the stock market. From 2012 until just recently, the Yen and the Nikkei traded almost tick for tick.

But look closely at the last six months. The Nikkei is running like it stole something without a corresponding decline in the Yen. Could it be that something changed?

Maybe the aggressive balance sheet expansion is behind us?

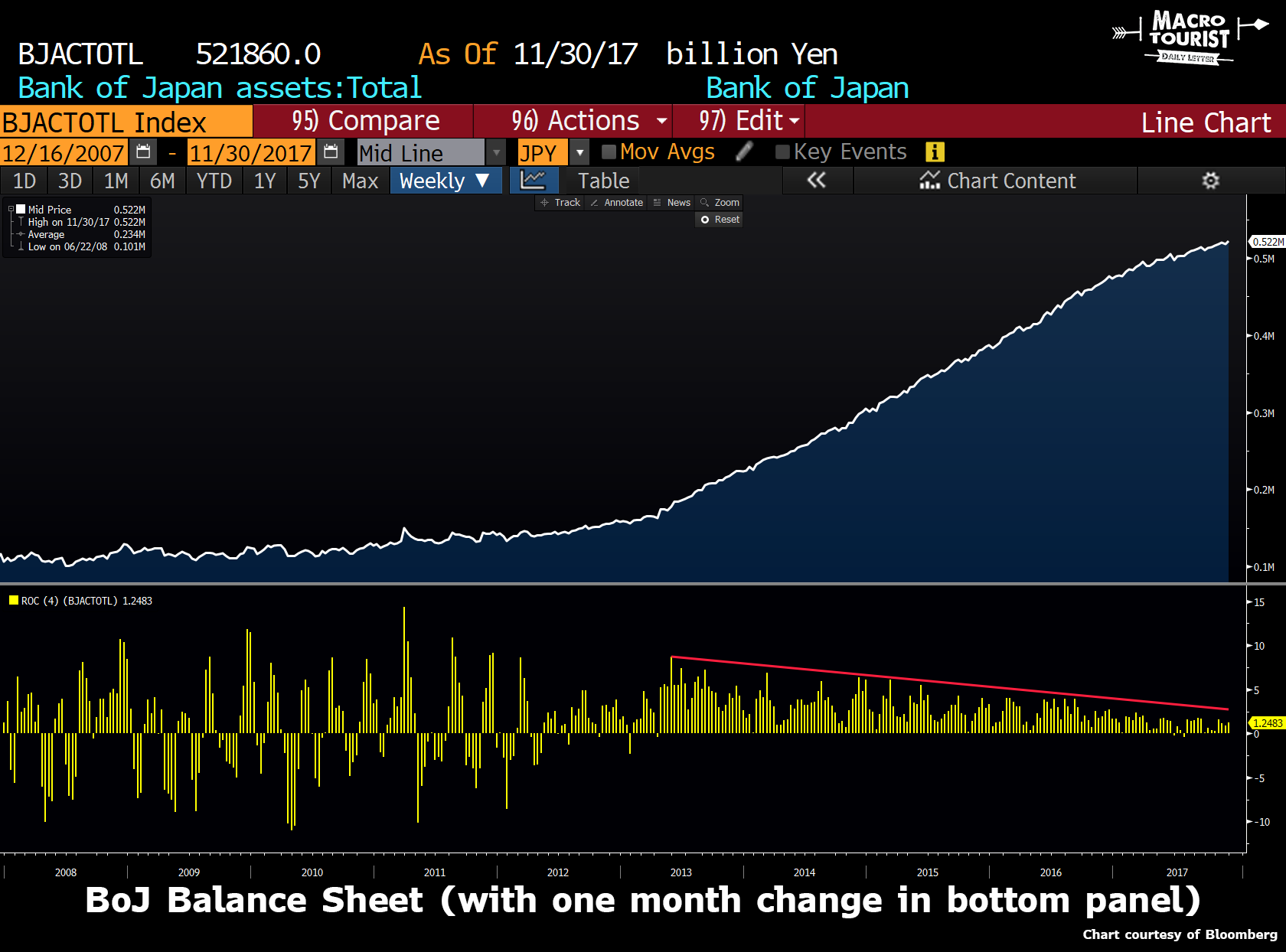

Even though the BoJ balance sheet chart looks like a one-way rocket to the moon, if you look closely at the data, it becomes apparent that the rate of change is slowing.

And it’s finally getting noticed. From the Nikkei:

TOKYO – The Bank of Japan is slowing the supply of money, arousing speculation that it is paving the way for a trimming of its ultra-easy monetary policy.

The supply of funds to the market in November showed an increase of 51.7 trillion yen ($458 billion), effectively the smallest annual pace of growth since the BOJ introduced easing of a “a different dimension” in April 2013. The central bank is steadily shifting the focus of its easing policy to controlling interest rates, away from “quantitative” measures, as prices have doggedly refused to rise.

The BOJ implemented powerful easing measures, accompanied by a few surprises, in the first half of Haruhiko Kuroda’s governorship starting in March 2013. Now, in little more than a year, the central bank has shifted to a waiting game while paying attention to financial institutions.

On Monday, Kuroda said at a Europlace financial forum in Tokyo that since changing the monetary easing framework in September 2016, there has been no change in either the BOJ’s policy or its thinking. He said the BOJ has secured financial stability, and control of the the yield curve is going well.

The BOJ had maintained yield curve control “quite effectively and efficiently without creating financial problems,” he said, adding that current levels of the BOJ’s yield targets were “quite appropriate.”

According to a plan announced at the end of November, the BOJ will continue cutting the purchase of short-term Japanese government bonds in December. An increasing number of participants in the bond market are starting to forecast that the BOJ will further reduce purchases of JGBs and raise the target rate of long-term rates from zero next year.

When the BOJ introduced its aggressive easy-money policy several years ago, Kuroda said the central bank would “double the monetary base in two years,” making the monetary base the target of easing measures.

The BOJ supplies funds to the market through such means as issuing banknotes and buying government bonds. Japan’s monetary base – the total amount of money supplied by the BOJ – exceeds 470 trillion yen, up more than threefold over the past five years.

But growth of the money supply has been slowing sharply. While the BOJ supplied money at roughly an annual pace of 80 trillion yen last year, the pace began slowing by stages at the start of this year. In November, it came to 51.7 trillion, the smallest amount in four years, as the easing policy was held in check in its initial stages in April-July 2013.

‘Stealth tapering’ is the new buzz word. Expect it to get increasing amount of attention in the future.

But make no mistake, this tapering is quite gentle. The tapering is at the margin, and the BoJ is still there providing tons of support to the economy.

The Yen is the cheapest major currency

I am a firm disciple of Richard Koo’s Balance Sheet Recession theories. Japan’s stop and start policies were the real impediment of the last two decades of moribund growth. And in pulling off the gas each time a self-sustaining recovery was in sight, the Japanese ultimately made their long run problem of too much debt all the worse.

Yet this time Japan is not making the same mistake. And I believe it is working. Devalue your currency, put rates to zero, expand the Central Bank’s balance sheet, and eventually, the stimulus will work. Yeah sure there is a lag, but do enough of it, and it can overpower the greatest deflationary mindset.

And that’s where we are today. After decades of workers getting no pay increases and prices generally falling, a new era has emerged in Japan.

I know it’s not dramatic, but it’s finally happening. From the WSJ:

TOKYO - Here is one sign of how robust the world economy is getting: Even in deflation-wracked Japan, some companies believe conditions are strong enough to raise prices.

Torikizoku Co. , a budget restaurant chain offering sticks of yakitori grilled chicken, lifted prices for the first time in nearly 30 years in October. It now charges the equivalent of $2.65 for a two-skewer plate, up from $2.49 before. It was egged on by a shortage of part-time staff, which forced it to pay higher wages, a spokesman said.

And the beer to wash it down is getting pricier, too: Japan’s four major beer companies recently decided to raise prices for the first time in a decade.

Making diners pay 8 cents more for a skewer might not be news elsewhere, but it could be a breakthrough for Japan, which struggled through 15 years of deflation beginning in the late 1990s. Prime Minister Shinzo Abe has put defeating deflation at the center of his economic revival plan.

The Japanese economy grew slightly in the latest quarter, thanks entirely to exports, and makers of products such as memory chips and battery parts have been revving up production.

Since the working-age population is shrinking, the overseas demand is driving a severe labor crunch for employers. In October, there were 155 jobs available for every 100 job seekers, according to data released Friday, the strongest showing in more than 43 years.

“Upward pressure on prices stemming from the rise in wage costs has been mounting,” said Bank of Japan Gov. Haruhiko Kuroda in November.

It’s anecdotal, and it’s far from truly inflationary, but it’s a step in the right direction.

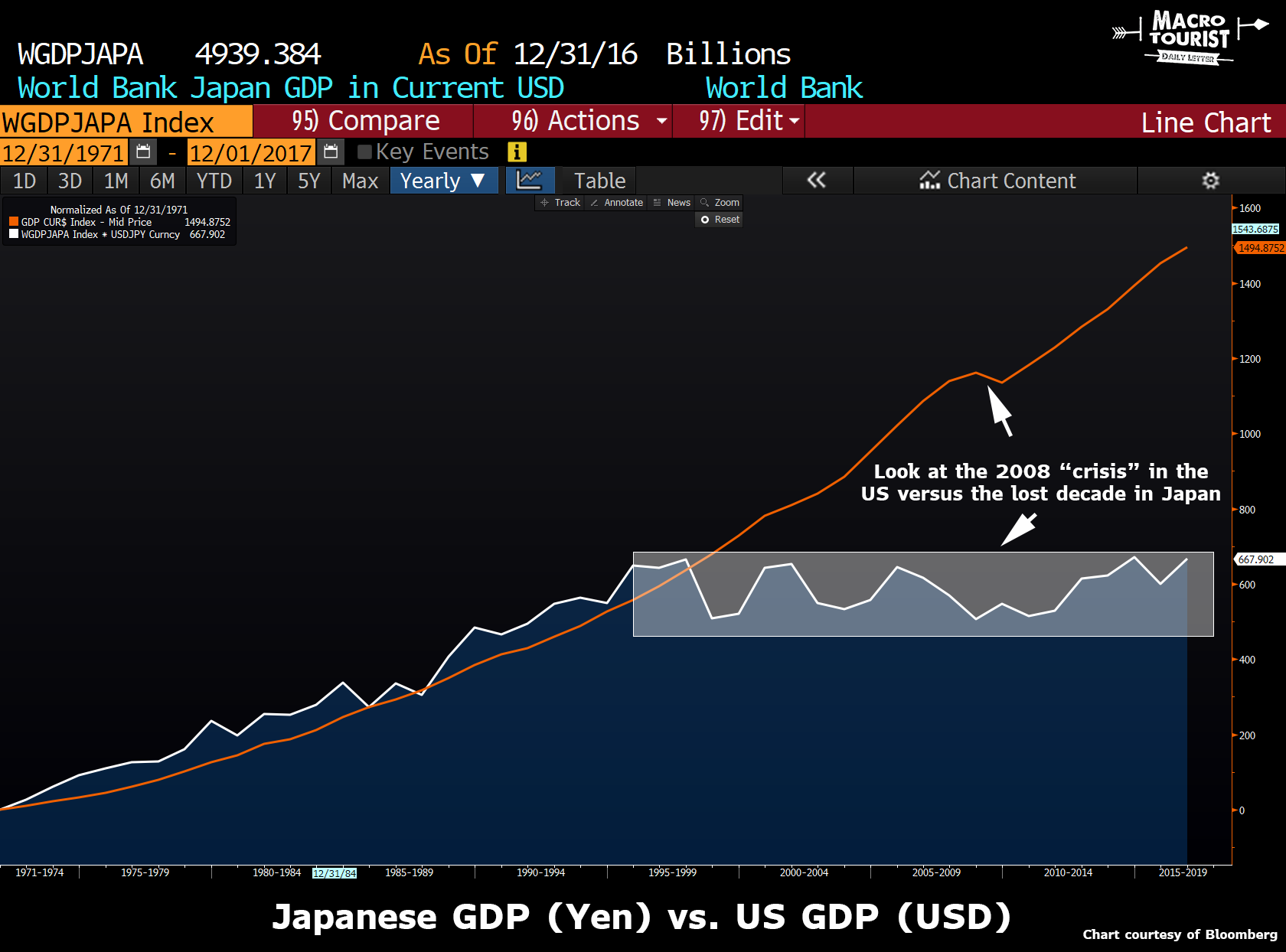

The Japanese lost decade

It’s tough for foreigners to understand the extent of the Japanese economic pain of the past few decades. Remember all the problems from the 2008 financial crisis? Well, have a look at the dip in US GDP during that period versus the Japanese experience of the last twenty years.

Instead of one year of poor economic performance, imagine that dragging on for a couple of decades.

The Japanese economy has been sucking wind for much too long, and the truly amazing part has been the patience of the Japanese people during this period.

But that’s in the rearview mirror. The economic engine has started, and it’s about to accelerate. Not only that, the tank is full of gasoline, and the car has been stripped of all the extra weight. What do I mean by that? Well, the past five years of extreme monetary stimulus has weakened the Yen to a level that makes it the cheapest of the major currencies.

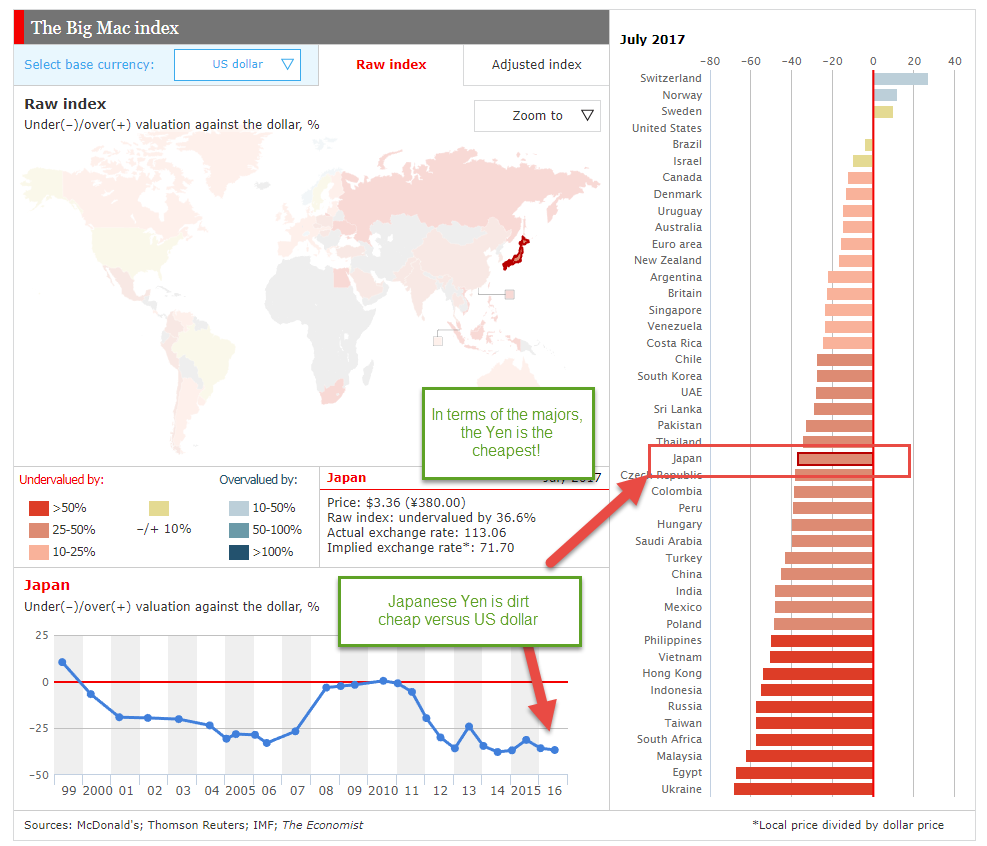

Have a look at one of my favourite indicators - the Big Mac index, a derivative of the purchasing power parity measure.

Japan is dirt cheap. Not Ukraine or Egypt cheap, but for the world’s third largest economy, it is inexpensive.

And with all the changes, it is starting to get noticed by investors. Recently RealVision TV did a whole series on the attractiveness of Japan. Here are some of the more important sections:

Alex Klinmont: So the cheapest commodity in Japan is Japanese labor. If we compare minimum wages around the world, we find that the minimum wage in Tokyo is $8.32 an hour. The minimum wage in Los Angeles is $15 an hour for companies with more than 26 employees.

There are no G-7 countries which have a minimum wage system in which the minimum wage is lower than that of Japan. So Japanese labor is relatively cheap. So Japan is actually a very good place to employ people on an international basis, particularly when you quality-adjust the labor force. You have a relatively well-educated,relatively sophisticated labor force that is not resistant to the introduction of new technologies. But the combination of deflated wages domestically and a very, very low, finally, a reasonably priced yen is an unbeatable combination. And that will, in due course, excite attention from international business, and from domestic business.

Jesper Koll: And what I mean by that, is that because labor is in short supply, the number of university graduates is declining every year by about 30,000 kids. As a result of that, wages and employment conditions are improving very dramatically. This year starting salaries for university graduates are up by more than 6%. 98% of university graduates, 98% of Japanese university graduates, got a full time job offer within 10 days of looking for one. So it’s incredible. And of course, as this new middle class rises, you’ve got greater job security, you’ve got rising incomes. Because of the scarcity of labor, because of the demographics, more and more companies, leading companies like Toyota, like Hitachi, like Fast Retailing, are rehiring part-time employees on a full-time basis. And that kicks off a very powerful positive cycle. As a part-time worker, you have no access to the corporate bonus. So the moment I get rehired on a full-time basis, I do get access to the bonus, which in Japan is about 1⁄3 of your annual income.

Brian Quartarolo: The data that I’m most encouraged by in Japan, right now, is productivity. So the productivity gains that we’re seeing in Japan are outstripping those that we’re seeing in other, developed markets, which is very encouraging. The fact that that’s occurring alongside wages starting to rise is exactly what you would want to see. So if labor markets in Japan are tightening to the point where we’re starting to see wages turn up alongside the productivity improvements, those are the sort of green shoots that the BOJ wants to see. I think it’s is the reason to be bullish Japanese shares, if you’re looking for relative out performance.

Jesper Koll: Innovation is, of course, the big focus. And there are people critical of Japan and say, oh my god Japan hasn’t invented anything since the Sony Walkman. Well, that’s actually not true. Look at the car industry. Lexus is obviously one of the super brands that has come out of nowhere and is now competing at the very, very top end of the luxury food chain here. One way of looking at that is, when you look at research and development as a share in GDP, Japan is at almost 4%. Which is one of the highest in the world. When you need to build a railway, when you need to build the ship, when you want to have the best tire in the world, you have to go to a Japanese company.

Brian Quartarolo: So if labor markets in Japan are tightening to the point where we’re starting to see wages turn up alongside the productivity improvements, those are the sort of green shoots that the BOJ wants to see. And on a medium-term basis, I still view this as being one of the more bullish and really one of the more exciting moves that we’ve seen in recent years that I think has a potential to continue. I think that the big surprise in 2018, is going to be the Japanese economy growing at 3%.

Of course RealVision had some doomsdayer-the-debt-will-blow-up Japan types on as well, and although you might be sympathetic to that argument, I am just not sure that this scenario is in the cards anytime soon. I don’t think Japan’s end game comes from economic weakness, but instead occurs when inflation takes off. And in the meantime, even if that is the final outcome, I suspect that for a while, inflation will be cheered by investors (especially in the initial days). It will feel good, even more so after decades of stagnant prices. Companies with pricing power and workers earning more will be greeted enthusiastically by markets.

Tax cuts that makes sense

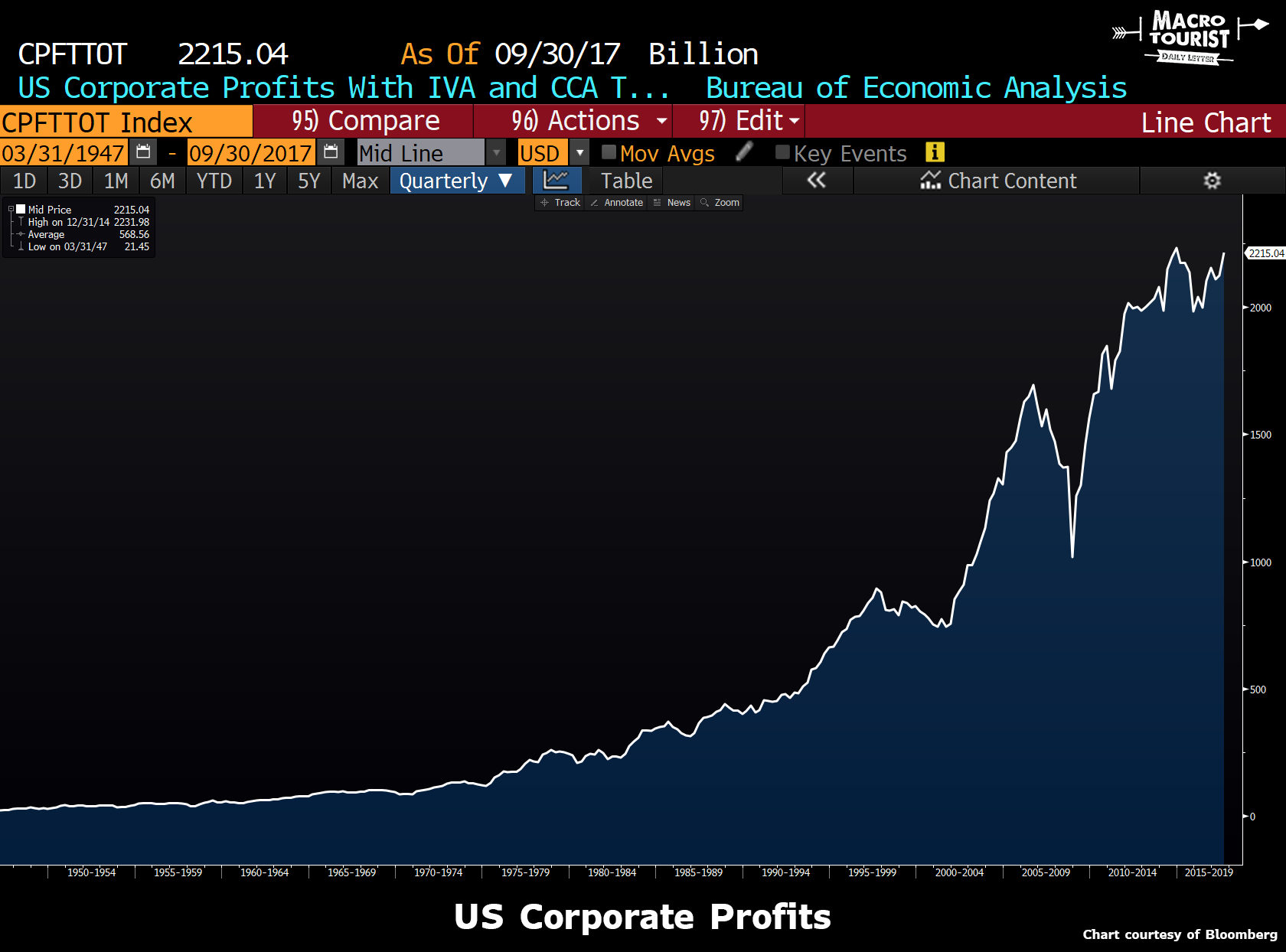

This morning the US stock market is celebrating this weekend’s passage of the Republican tax bill. Although I understand why equities should rally on the news, I worry the market is greatly overestimating the stimulative effect on the US economy as a whole. Yeah, I get it - corporations will now have more money to invest in capital expenditures or to give their workers a raise. But let’s face it - corporate profits were already hitting new highs.

When you combine the absurd monster corporate profits with the rock-bottom interest rates and the cheap bountiful credit, you need to ask yourself whether there was really any impediment to US companies doing so before the tax cut? Although the reduction in the tax rate will be stimulative, it will translate into much less real economic growth than the optimists predict. Most of the corporate tax cuts will simply flow directly to shareholders’ pockets.

Yet Japan is taking a much different tack to corporate tax cuts. From the Nikkei:

TOKYO – The Japanese government is considering rewarding businesses that increase wages and invest in productivity growth by offering tax breaks that could lower their effective tax rates to as low as 20% or so.

A draft proposal for the tax breaks states its main goal is “reducing the tax burden to a level that will help companies compete well in the world.”

Under the proposal, companies that actively invest in human resources through training and higher wages would be allowed to deduct a certain amount from their tax liabilities. This measure alone could lower the effective tax rate to the mid-20% level.

Furthermore, companies that also invest in innovative technologies, such as the “internet of things” and artificial intelligence, to boost productivity will receive additional tax breaks, potentially reducing their effective tax rates to as low as about 20%.

Under Prime Minister Shinzo Abe, the government has been lowering the effective corporate tax rate to make Japan more attractive for businesses. Since he came to power, the overall effective corporate tax rate in Japan has fallen from 37% to 29.97%. In fiscal 2018, which begins next April, the rate is already slated to decline to 29.74%.

Corporate earnings overall have improved along the way, but higher profits have largely been hoarded, despite repeated calls by the prime minister for employers to lift wages and help stimulate economic growth.

To encourage businesses to comply, the government was already considering reducing the rate to around 25% for companies that raise wages. But it is leaning toward upping the ante given that other countries, including the U.S. and France, are also working toward reducing corporate taxes.

The Japanese government is also examining the idea of slashing fixed-asset taxes to help small and midsize businesses boost productivity. The measure will likely cover new machinery and other fixed assets. The current rate of 0.7% may be reduced to zero.

The draft proposal, a temporary measure for three years starting in fiscal 2018, will be included in a policy package to spur productivity. The package is expected to be approved by the cabinet on Friday, with the specific tax rates to be hashed out by the tax panels of the ruling parties.

Linking tax cuts to actual investment and worker wage raises will do so much more to stimulate the economy than a simple “hand-out and hope” strategy. Sure, for the short run an investor’s capital will be treated better in the United States, but in the long run, creating a sustainable economic recovery that benefits all aspects of the economy will result in much better returns.

Putting it all together

After a couple of decades of terrible monetary and fiscal policies, Japan has turned the corner, and will finally achieve escape velocity. This will occur with Japan having one of the G7’s cheapest currencies. The result will be capital flowing into Japan as investors realize it isn’t another false dawn. As we have seen over the past six months, the Japanese stock market has already started rising without the Yen declining. This equates to real growth. And it will continue.

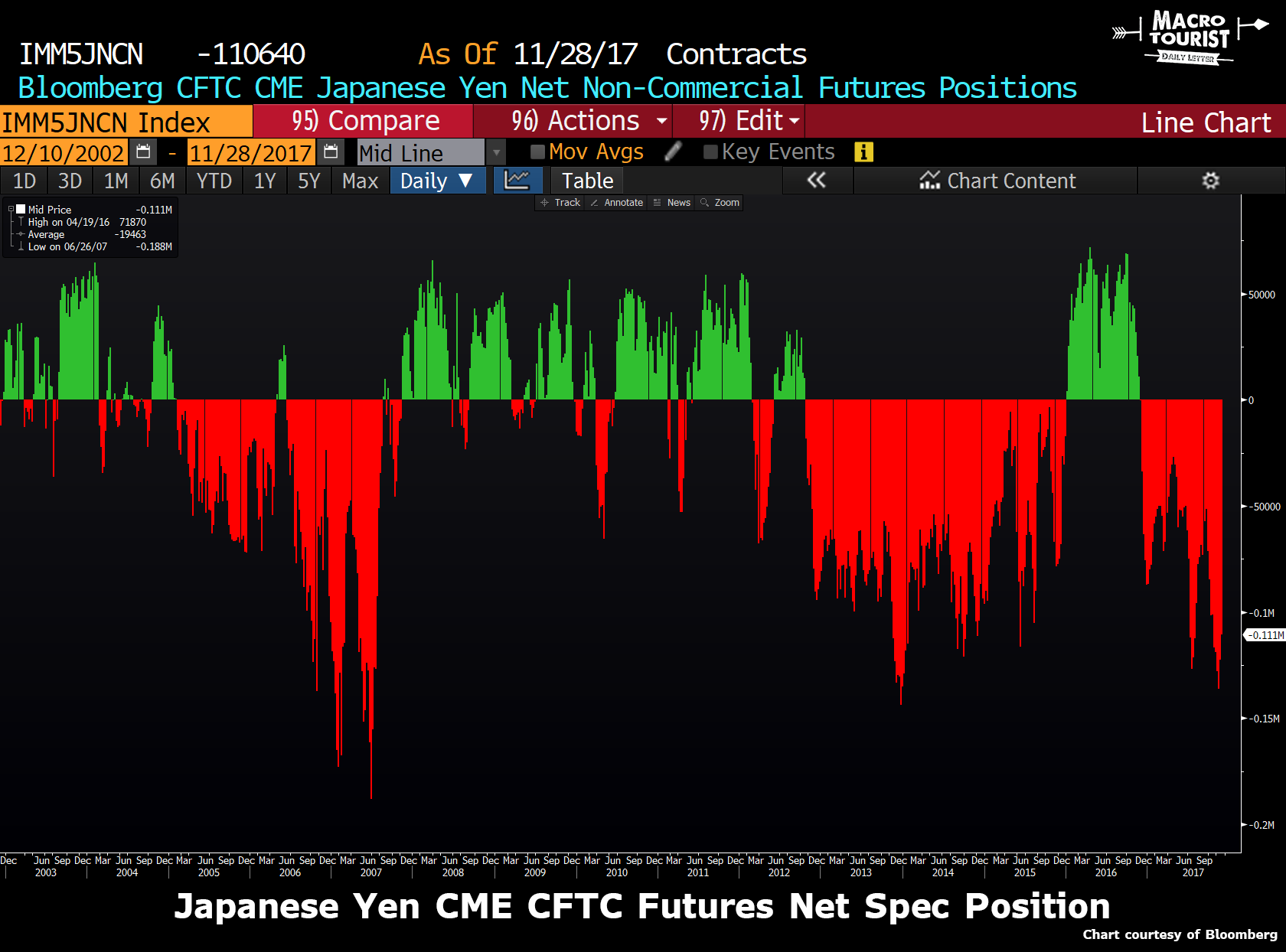

As for the hot money, although they have embraced the Japanese stock market rally, they are still doing so only a “currency hedged” basis. Look at the CFTC positioning of the Yen. Speculators are still heavily short Yen.

Using the Yen as a funding currency during the recent massive global risk rally has remained in vogue. Yet the truly interesting part? The Yen is no longer declining. In fact, the relationship between the Yen and risk assets seems to have completely broken. Stocks and other risk assets are exploding upwards, yet the Yen is treading water.

What would happen if, God forbid, global stocks sink? I know, I know - stocks don’t go down silly. Although I would love to buy into the narrative that stocks will continue rising forever, somehow I doubt we have entered into some sort of new paradigm that enables investors to never lose. Buying Yen in an environment where it should be going down, yet it’s not, seems like a great potential hedge. Often the best signals are non-confirmations.

So I am starting to establish a long Yen position. There is no doubt that this is a lonely position. Who the hell would buy Yen when the BoJ has an infinite stack of blue tickets (and is paying for it with newly created Yen)? Yet I think this narrative is fully baked into the current Yen price, and the market is underestimating the ‘stealth tapering.’

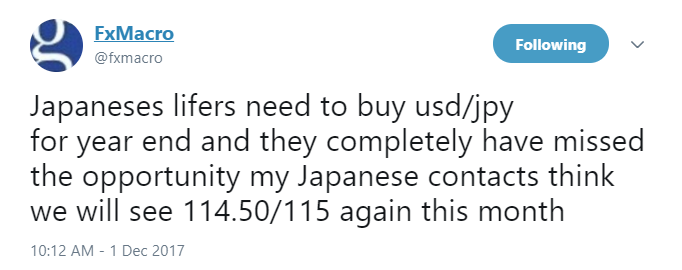

Most everyone thinks USDJPY is heading higher (lower Yen).

Heck, even the Japanese think their currency is going to zero.

Although I had previously traded the US dollar from the long side (The Fall Guy), I think that trade is over. I want to be short US dollars, and I think the best currency to be short against is the Japanese Yen.

The Yen should be going lower, but it’s not. That’s telling you something. And I am listening.

I am in no rush to put all the position on immediately. Working it in over the next couple of weeks makes a lot of sense. This is a longer term position, and I anticipate the large descending triangle of the USDJPY rate to resolve itself with a breakdown below 109.50.

This morning the excitement of the US tax cut bill passage is causing the Yen to decline, giving us a great day to start establishing the position.