Via Global Macro Monitor,

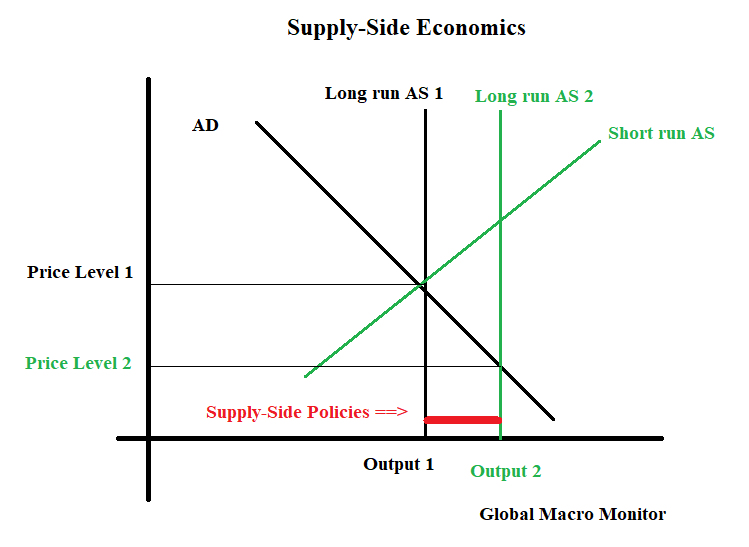

No, we are not talking about President Reagan’s supply-side economics - policies to increase productivity with the goal of increasing long-term aggregate supply or output while simultaneously reducing inflation.

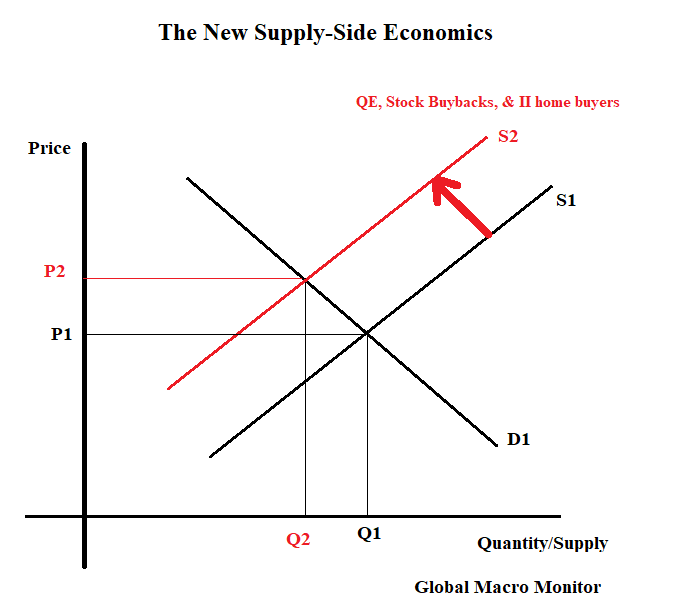

We now have a new kind of supply-side economics, just the opposite of Reagan’s, which effectively restricts, removes and shifts the supply curve to the left, increasing prices and fueling asset bubbles in risk-free bonds, stocks, and housing.

Risk-free bonds

We have written extensively on how the global central banks have created artificial shortages of risk-free bonds through quantitative easing (QE). See here and here.

The last data we analyzed has the Federal Reserve owning over 20 percent of marketable long-term Treasuries (> 1 year) and about 35 percent of the longer-term bonds (2027-2047 maturities). The U.S central bank has thus removed or restricted the supply of over $2 trillion of risk-free bonds in the market.

This has distorted the most important price in the world, the 10-year T-Note interest rate, of which, all other risk assets are priced.

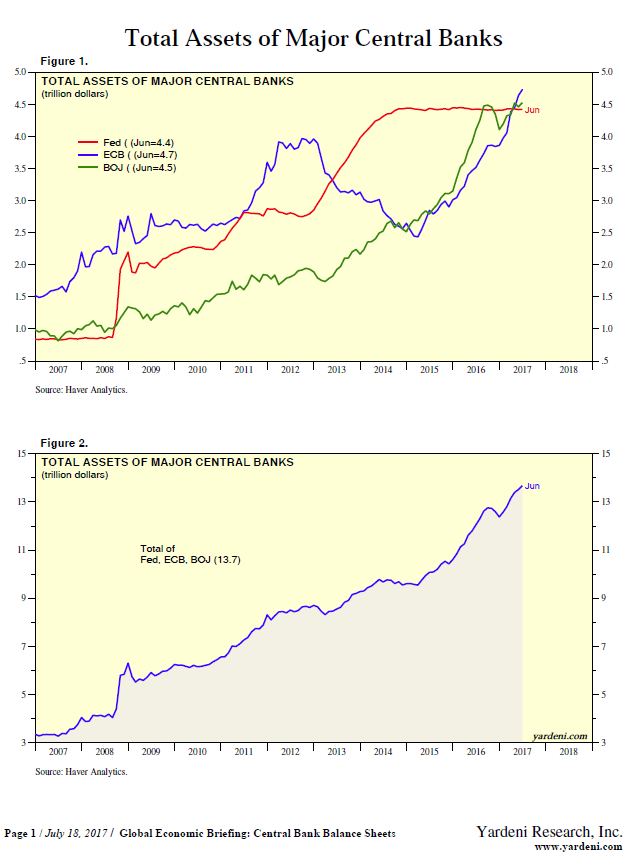

Using data from the beginning of last year, the new supply-side economics, in totality, have had global central banks:

- removing $12.3 trillion in fixed-income securities and some equities (BoJ) through asset purchases in global QE programs;

- creating $8.3 trillion of global debt yielding zero percent or less;

- and now rendering a population of 489 million living in countries with official policy rates less than zero.

Here are more recent data from Ed Yardeni’s, Global Economic Briefing, on the size of the big three central bank balance sheets,

We don’t have an estimate, or any idea, of where the 10-year yield should be trading without QE, but we are certain it would be much higher. An artificial and repressed risk-free rate distorts the markets and economy in several ways:

- Distorts the market signal of interest rate movements;

- Punishes savers and forces them to seek higher yields in riskier assets;

- Reduces the interest income of seniors dependent on savings who are at the mercy of CD interest rates, forcing a reduction in consumption and economic growth;

- Effectively defunds pensions funds, increasing their unfunded liabilities;

- Forces consumers to save more as interest rates and returns are repressed, reducing economic growth;

- Distorts valuations of all assets as it artificially lowers the discount rate;

- Encourages government largesse by financing government deficits;

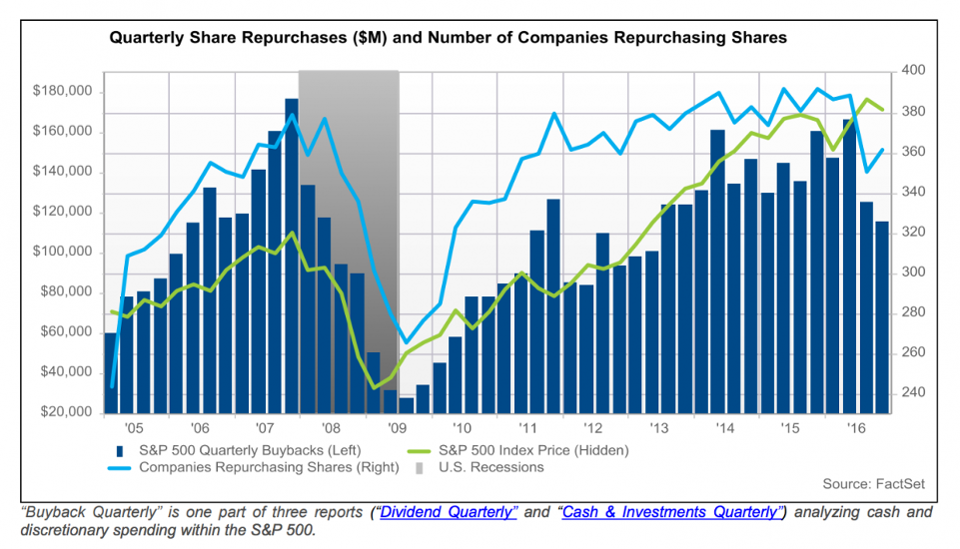

- Incentivizes corporations to engage in debt financed buybacks rather than CAPX;

- Results in a gross and inefficient misallocation of capital;

- Creates almost “free money” the main culprit of almost all asset bubbles;

- Many others.

“...money seemed ‘free’ (money always seems free in manias).“ – Charles Kindleberger, Manias, Panics, and Crashes, p.10

Oddly, it doesn’t feel like we are in the mania stage quite yet. This, coupled with the restricted supply and the buy the dipper algos, makes prices sticky to the downside and has contributed to record low volatility. All this makes us think there may be some runway left for risk markets, paving the way for a potential blow-off top in the fall or later.

Let us reiterate what we have said in earlier posts. No judgement on the policy makers. They saved the system with their bold actions and kept many of us — from janitors to investment bankers — from living under the local freeway. They are now painted in a corner, however, and have a very narrow window or path to a soft landing.

Stocks

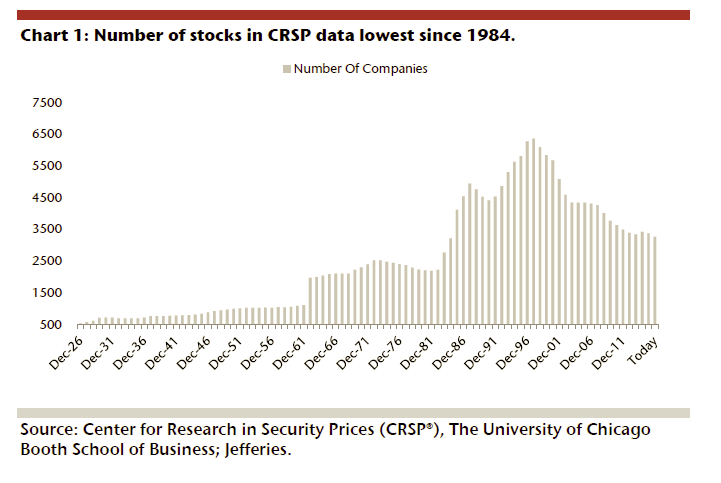

Massive supply has been taken out of the market

“Between the lack of IPO activity, the pickup of M&A, and buybacks, the U.S. equity world is becoming smaller and smaller, and this could be one of many reasons why active managers are lagging behind their indexes. Companies may not want to come public due to the additional cost of Sarbanes-Oxley or the fact that the private market has become a bigger source of financing than it has been in the past.”

…For the curious, DeSanctis shows the number of common stocks is half as many as 1997’s peak of 6,364. – CNBC

A few days ago, Zero Hedge cited a piece by Credit Suisse,

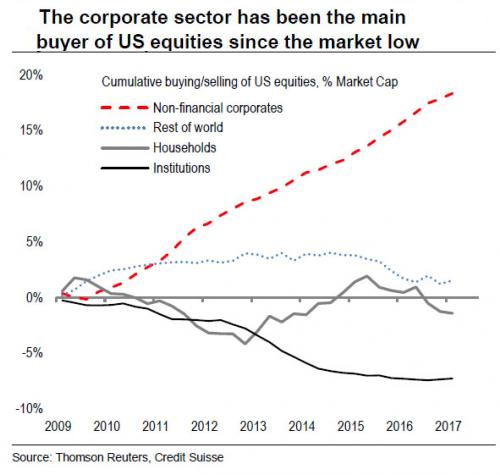

Andrew Garthwaite writes, “one of the major features of the US equity market since the low in 2009 is that the US corporate sector has bought 18% of market cap, while institutions have sold 7% of market cap.” – ZH

Zero Hedge concluded, “companies…have engaged in the greatest debt-funded buyback spree in history.”

Finally,

“…Goldman Sachs’ chief equity strategist David Kostin estimated that, in 2017, S&P 500 companies will spend $780 billion on buybacks?—?a new record.”

– Forbes

Housing

Consolidation in the residential rental industry has led to just a handful of companies and real estate trusts holding a huge percentage of the market. For example, last year, American Homes 4 Rent, the second-largest holder of single-family home inventory (47,000 homes in 2015) next to the Blackstone Group (50,000), merged with American Residential Properties in a $1.5 billion deal, giving them a combined valuation of more than $5 billion. According to The Journal, the six biggest holders of for-rent, single-family homes have spent more than $28 billion on property acquisitions since the market’s peak.

– ConstructionDive

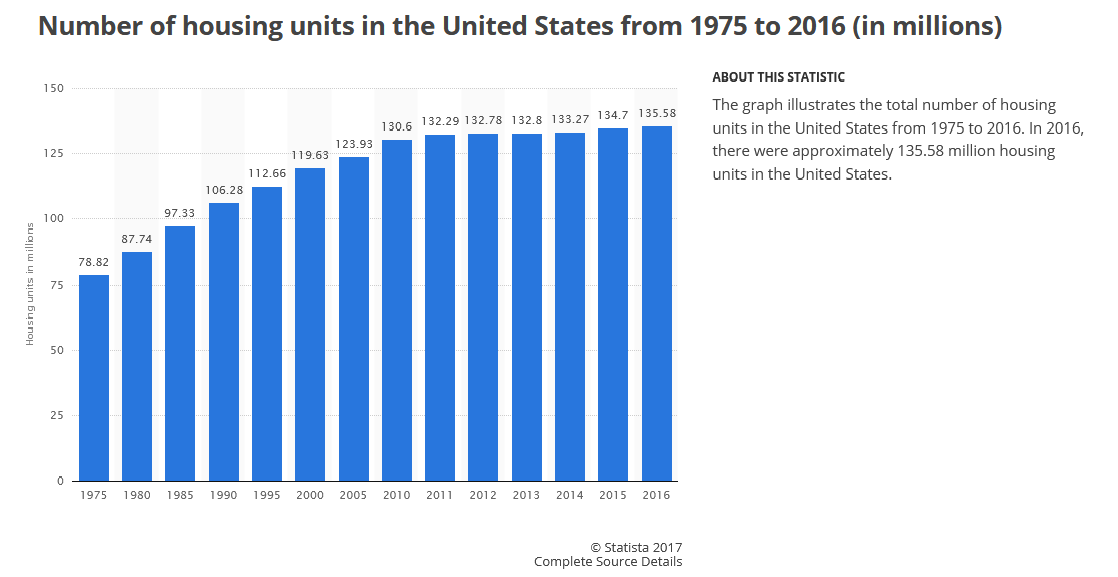

Since the end of the great recession, institutional investors have been buying up single family homes in droves with the purpose of renting them out. This disrupts the traditional flow of buying and selling in the housing market as it takes a substantial amount of supply off the market almost permanently.

“We own about 100,000 either multifamily homes or single-family homes for rent.” – Jonathan Gray, global head of real estate, Blackstone Group

This also increases the pricing power of homeowners to raise rents as supply becomes more concentrated. In many parts of the country rents have been skyrocketing.

Furthermore, new building has been relatively flat. Take a look at the graph below.

Conclusion

The new supply-side economics as we have briefly outlined above, allows us to say, “this rhyme is different.” The assets bubbles we see today, maybe with the exception of credit, are largely driven by supply restrictions rather than credit fueled demand as was case in the 2007 bubbles, though a case can be made that stock buybacks are driven by “free money.” It is important to distinguish between central bank base money, which is driving today’s global economy and markets, and credit based money, which was behind the 2007 bubble economy and evaporated almost overnight with the “Lehman Moment.”

What worries us most is the political blowback if rents and housing prices continue to rise. The younger generation is effectively locked out of the housing market, which will only increase the populist backlash and the “Clash of Generations“.

Many young adults are sitting on the sidelines of the housing market…new data shows that one huge factor is the competition — some might say unfair competition — young adults face from investors who can just swoop in, drop a pile of cash and buy the houses they want. These investors then turn around and rent these properties to those same young adults for increasing amounts every year, making it even tougher for young would-be homeowners to ever save up enough money for a down payment. — Money