Pondering The Real Perils Of Risk Parity Portfolios

Authored by Kevin Muir via The Macro Tourist blog,

The other day, fabled hedge fund manager Paul Tudor Jones made headlines when he issued a bold warning to Janet Yellen & Co. (from Bloomberg):

Authored by Kevin Muir via The Macro Tourist blog,

The other day, fabled hedge fund manager Paul Tudor Jones made headlines when he issued a bold warning to Janet Yellen & Co. (from Bloomberg):

I am going to demonstrate something to you. Pay attention spectrum loving democrats.

This is Bill Nye in 1984, before he became a fucking idiot. Notice how the young lady possessed decorum and displayed grace whilst trying to teach America's youth about science and gender. The lesson was simple: XX equals girl, XY equals boy.

Earlier today, MarketWatch highlighted the rather blunt investing advice that the 'highly reputable' investing newsletter, The Prudent Speculator, and its editor, John Buckingham, recently offered up to millennial investors:

“If you are 50 or younger, or have 10 years before taking money out, and do not have 100% in equities, you are crazy.”

Former Obama adviser David Axelrod dropped a little more truth on the hosts of CNN's New Day this morning than they were expecting when they asked him to weigh in on Hillary blaming her 2016 defeat on Comey and WikiLeaks. Rather than knocking the softball out of the park by blasting Comey and 'Russian interference," Axelrod decided to say what most people are thinking when he concluded: "If I were her, I would move on."

Authored by Charles Hugh-Smith via OfTwoMinds blog,

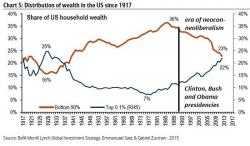

You may have seen these charts before, but they tell the story of a middle class in decline.

For any system to endure, it must maintain a built-in capacity to self-correct: that is, it must generate accurate informational feedback about dangerous asymmetries and auto-correct with behavioral feedback.