“Bigger Systemic Risk” Now Than 2008 - Bank of England

“Bigger Systemic Risk” Now Than 2008 - Bank of England

“Bigger Systemic Risk” Now Than 2008 - Bank of England

Another new week, another day with not much going on. So much, or rather little so, that in its daily wrap Citi starts off with the following: "Pop Art pioneer Andy Warhol, who once said “I like boring things”, would have been a huge fan of today’s session thus far. Though several events of note linger on the horizon for later this week, G10 is firmly on the beach as of this morning."

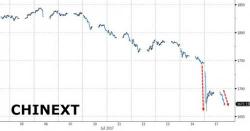

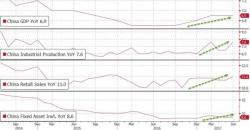

Despite China reporting solid economic data on Monday, with beats across the board in everything from retail sales, fixed asset investment, industrial production and GDP printing at 6.9% and on track for its first annual increase since 2010...

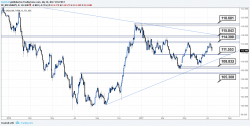

FX Week Ahead, courtesy of Rajan Dhall from fxdaily.co.uk

Coming off the back of another bad week for the USD, we look to a barren period for the data schedule in the US, so markets will have to determine whether to extend this weakness based on the evidence so far.

Authored by Pepe Escobar via Asia Times,

China and Syria have already begun discussing post-war infrastructure investment; with a 'Matchmaking Fair for Syria Reconstruction' held in Beijing

Amid the proverbial doom and gloom pervading all things Syria, the slings and arrows of outrageous fortune sometimes yield, well, good fortune.