You are here

Asia

There Is No Hillary Clinton ‘Doctrine’

Jeffrey Stacey is looking forward to how Clinton will conduct foreign policy, which he assumes would have magically remedied almost all current problems overseas:

What Does The Next OPEC Meeting Have In Store?

Submitted by Rakesh Upadhyay via OilPrice.com,

The next OPEC meeting on the 2nd of June will act as little more than a forum for continued altercations between Saudi Arabia and Iran.

The 2 June 2016 OPEC meeting will be held amid a backdrop of oil prices near $50 per barrel, a sharp drop in Nigerian production due to sabotage, turmoil in Venezuela, Saudi Arabia operating with a new oil minister, and Iran aggressively pumping close to pre-sanction levels.

Something Stunning Is Taking Place Off The Coast Of Singapore

"I've been coming to Singapore once a year for the last 15 years, and flying in I have never seen the waters so full of idle tankers,"

- Senior European oil trader a day after arriving in the city-state.

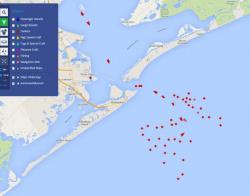

Back in November, when the world-record crude inventory glut was still in its early innings, we showed what we then thought was a disturbing image of dozens of oil tankers on anchor near the US oil hub of Galveston, TX, unwilling to unload their cargo at what the owners of the oil thought was too low prices.

Two Things Are Bothering A Bearish Dennis Gartman

It had been a bad week for Dennis Gartman who just yesterday admitted that Wednesday "was our worst day of the year thus far, as that which we were long of fell and that which we were short of closed unchanged. Long ago we learned that when things go awry and do so as “majestically” as they did yesterday it is best to simplify, simplify and to simplify again. Getting smaller; getting less involved; curtailing positions in numbers and sizes is the only proper way to respond and so we did exactly that.