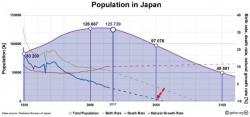

In 300 Years, There Are Only 300 Japanese Left...

Via GEFIRA,

The world’s third largest economy has an aging and shrinking population and will simply disappear. The low fertility is not unique to Japan. The same problem besets Taiwan, China and Korea as well as the United States and Europe. In the West the establishment has opted for population replacement.