"Canada Is In Serious Trouble" Again, And This Time It's For Real

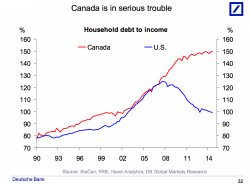

Some time ago, Deutsche Bank's chief international economist, Torsten Slok, presented several charts which showed that "Canada is in serious trouble" mostly as a result of its overreliance on its frothy, bubbly housing sector, but also due to the fact that unlike the US, the average household had failed to reduce its debt load in time.