The Bank Of Japan Already Owns Over Half Of All ETFs; It Wants To Own More

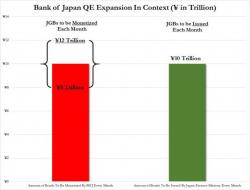

Less than six months after we pointed out that the BoJ owns 52% of the entire Japanese ETF market, Reuters reports that the Kuroda's Peter Pan fairy tale, aka the Bank of Japan, is thinking about buying even more. The BoJ is said to be currently buying $30 billion of ETF's a year under its current policy, however since the Nikkei is down over 10% this year, that figure is apparently not enough to keep the market propped up.

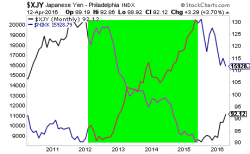

Here's how the BoJ's holdings in the Japanese ETF market looked visually in recent months: