What Savers Do Under NIRP - The "Perversely Negative" Impact Of Going Negative

Authored by Mark Cliffe, originally posted at VoxEU.org,

Authored by Mark Cliffe, originally posted at VoxEU.org,

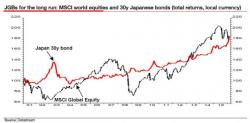

Two days after Japanese yields plummeted on January 29, when the BOJ unexpectedly stunned the world by announcing negative interest rates, the Japanese government sold 10 Year Bonds at what was then a near record low yield of 0.078% in an auction which carried a 0.3% coupon. Since then things have only gotten more... deflationary, and as can be seen on the chart below, as of this moment the 10Y JGB is yielding a record-0.055%

Submitted by JP Koning via Moneyness blog,

Negative interests rates are the shiny new thing that everyone wants to talk about. I hate to ruin a good plot line, but they're actually kind of boring; just conventional monetary policy except in negative rate space. Same old tool, different sign.

Not only has the Yen strengthened and stocks collapsed since BoJ's Kuroda descended into NIRP lunacy but, in a dramatic shift that threatens the entire transmission mechanism of negative-rate stimulus, Japanese banks (whether fearing counterparty risk or already over-burdened) have almost entirely stopped lending to one another. Confusion reigns everywhere in Japanese markets with short-term interest-rate swap spreads surging and bond market volatility spiking to 3 year highs (dragging gold with it).

Albert Edwards is in love, but what makes it somewhat awkward is that the object of his affection is not living flesh and blood but a major asset, one which he calls "probably the most fantastic investment of the last decade", and one which so many others have called the "widowmaker" for the simple reason that they have shorted it, shorted it again, and shorted it some more, only to always lose money because as their adversary that have the most irrational, most childish and most desperate central bank in the world: the Bank of Japan.