The WSJ's Modest Proposal: The Bank Of Japan Should Buy Oil

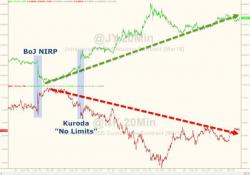

We have joked about it in the past: with equities around the globe all correlating tick for tick with the price of oil (supposedly "lower oil is good for the economy", just don't tell that to the stock market), instead of doing piecemeal interventions and monetizing stocks, something which as even Citigroup has noted no longer works, what central banks should do instead is monetize the source of all market problems: oil itself.

We first joked last January that the ECB should do it...