ECB Preview: Here's What Draghi Will Announce Today

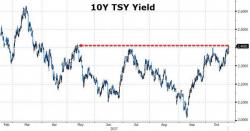

Today's ECB meeting is expected to be one of the most important in recent years: Mario Draghi has signaled, and is widely expected to announce a blueprint of what the central bank's QE tapering will look like beyond 2017, and while no actual tightening will be implemented - either via rates of asset purchases - the ECB is expected to announce it will cut its €60bn/month bond purchases in roughly half starting in January 2018 and lasting for the next 9-15 months.

Courtesy of RanSquawk, here are the key parameters of Thursday's meeting: