"Quant Quake": What Was Behind Last Week's Historic CTA Crash, And Is Another One Imminent

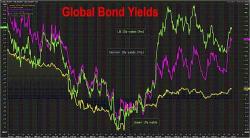

While on the surface the market last week did nothing all that exciting, below it things were in abrupt turmoil - driven by the decoupling between stocks and bonds and the volatile, countertrend move in commodities and oil in particular - which was nowhere more evident than in the world of Risk-Parity funds and CTA, which suffered their worst two-week plunge since 2003.