Your Last Minute FOMC Preview: "Will It Be A Dovish Hike Or Not"

Courtesy of RanSquawk

Courtesy of RanSquawk

When global financial markets crash, it won't be just "Trump's fault" (and perhaps the quants and HFTs who switch from BTFD to STFR ) to keep the heat away from the Fed and central banks for blowing the biggest asset bubble in history: according to the head of the German central bank, Jens Weidmann, another "pre-crash" culprit emerged after he warned that digital currencies such as bitcoin would worsen the next financial crisis.

In short, buy stocks.

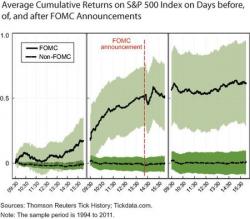

Remember that 2011 NY Fed study which found that since 1994, a stunning 80% of all equity returns on U.S. stocks were generated over the twenty-four hours preceding scheduled Federal Open Market Committee announcements, a phenomenon called the pre-FOMC announcement “drift.”

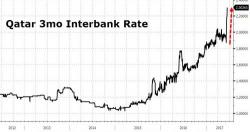

While the Saudi-led campaign to starve Qatar's citizens may end up short of the target, with both Turkey and Iran volunteering to provide needed staples to the isolated Gulf nation while local entrepreneurs have started a cow paradropping campaign to offset the decline in milk imports, a more pressing problem has emerged: Qatar's financial system is running out of dollars. As Bloomberg reports, several Qatari banks have boosted interest rates on dollar deposits to shore up liquidity as the Saudi-led campaign to isolate the gas-rich Arab state intensifies.

In an otherwise quiet morning as we await Jeff Sessions' testimony, a WSJ article is making the rounds which recounts the interactions between Trump and Janet Yellen - who it turns out were born two months apart in neighboring boroughs of New York City - according to which despite Donald Trump’s fierce criticisms of the Federal Reserve in the final weeks of the 2016 election campaign "the nation’s two most powerful economic-policy players—the president and the leader of the central bank—are "off to a surprisingly smooth start."