How The S&P 500 Will Spend $2.6 Trillion In Cash Next Year (Hint: Mostly On Stock Buybacks)

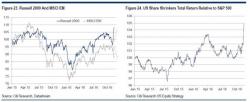

In light of expectations that the Trump fiscal stimulus plan will unleash a new Golden Age for the US economy, driven in part by the repatriation of hundreds of billions in funds held offshore, yesterday we showed a disturbing analysis from Citigroup according to which the bank's share-shrinker portfolio has soared relative to the S&P following the US election. The implication was clear: as fas as the market is concerned, much if not all of the capital repatriated from overseas will be promptly returned to shareholders, and maybe much of the corporate tax cut as well.