The Road to Recovery: Global Epocalypse Inevitable According to Trump’s Chief and World’s Largest Failing Bank

The following article by David Haggith was first published on The Great Recession Blog:

The following article by David Haggith was first published on The Great Recession Blog:

The challenges facing Germany's second-largest shipping lender, German Landersbank NordLB first emerged this summer, when we reported that the bank was considering taking full control of its smaller, distressed peer, Bremer Landesbank (BLB), which was struggling under the weight of a portfolio of bad shipping loans in what effectively constituted a state-backed bailout. BLB, of which NordLB already owns 54.8%, had warned that it would have to take a €400m writedown on its shipping portfolio, and that as a result it was facing a “mid-triple-digit million loss” this year.

Submitted by Mark O'Byrne via GoldCore.com,

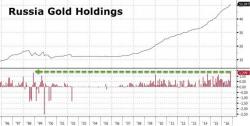

Russia gold buying accelerated in October with the Russian central bank buying a very large 48 metric tonnes or 1.3 million ounces of gold bullion.

This is the largest addition of gold to the Russian monetary reserves since 1998 and could be seen as a parting 'gift' by Putin to his rival ex-President Obama.

The Russian central bank gold purchase is the biggest monthly gold purchase of this millennium.

Russia gold buying accelerated in October with the Russian central bank buying a very large 48 metric tonnes or 1.3 million ounces of gold bullion.

This is the largest addition of gold to the Russian monetary reserves since 1998 and could be seen as a parting 'gift' by Prime Minister Putin to his rival ex-President Obama.

The Russian central bank gold purchase is the biggest monthly gold purchase of this millennium.

Despite speculation over the past year that Canada may join Japan and Europe in the NIRP club and launch negative interest rates, so far the BOC has stood its ground. However, starting on December 22, for the broker dealer clients of one of Canada's most reputable financial institutions, BMO Nesbitt Burns, it will be as if the Canadian bank has cut its deposit rate on most currencies, to match the deposit rate of Switzerland.