Has The ECB's QE Been A Failure? This Is What Europe's Banks Think

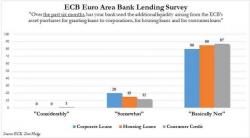

As the WSJ wryly put it this morning, "Officials at the European Central Bank surely celebrated Tuesday's survey showing the last barrage of asset purchases and negative rates had a positive effect on bank lending to households and businesses."

Alas, as the WSJ also adds, "policy makers may want to hold off uncorking the champagne just yet. In fact, most banks answering the survey said the ECB's policies had no impact at all."