Failure of the War on Cash

Failure of the War on Cash

Written by Jeff Thomas (CLICK FOR ORIGINAL)

Failure of the War on Cash

Written by Jeff Thomas (CLICK FOR ORIGINAL)

One month ago, when Mario Draghi unveiled his quadruple-bazooka QE expansion, which for the first time ever included the monetization of corporate bonds, the German press, in this case Handelsblatt, had a swift reaction. It did not approve.

Nearly a decade since the housing bubble burst the dirty skeletons still emerge from the closet, and still nobody goes to jail.

In the latest example of how criminal Wall Street behavior leads to zero prison time and just more slaps on the wrist, overnight Warren Buffett's favorite bank, Wells Fargo, admitted to "deceiving" the U.S. government into insuring thousands of risky mortgages. Its "punishment" - a $1.2 billion settlement of a U.S. Department of Justice lawsuit, the highest ever levied in a housing-related matter.

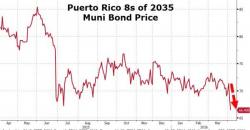

Yesterday, in the latest plot twist surrounding the inevitable Puerto Rico default, we observed that after the commonwealth island's Senate passed a surprising bill to impose a debt moratorium on any future debt repayment, its bonds - predictably - tumbled.