Fed Reports Unexpected Collapse In Credit Card, Auto Loan Demand

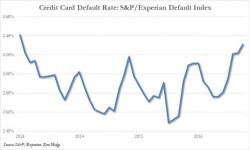

Two weeks after we reported that the consumer credit card default rate as tracked by S&P/Experian Bankcard had surged to the highest level since June 2013...

... we were looking forward to the latest Fed Senior Loan officer survey for more details about changing loan dynamics within US society.

What the report revealed was troubling: while on the surface, the Loan Officer Survey characterized loans to businesses as "basically unchanged" from the previous survey, it did remark that standards for commercial real estate (CRE) loans had tightened.