Chinese Economic Data Beats Across The Board After Record Credit Injection

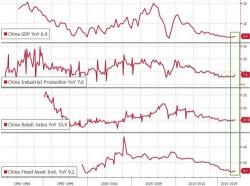

Overnight China reported a barrage of economic data for March and Q1, that not only showed the first back to back GDP acceleration in seven years, but beat across the board as investment picked up, retail sales rebounded and factory output strengthened, following record credit growth and a fresh rebound in China's property markets which defy Beijing's attempts to taper the country's newest housing bubble.

The Q1 data highlights: