Goldman Burned By These Corporate Debt Trades In Q1

Last week we noted that Goldman posted a 'yuge' miss in fixed income trading of $335 million (see "Goldman Misses As FICC Disappoints, Stock Slides As Average Banker Comp Hits $360K"):

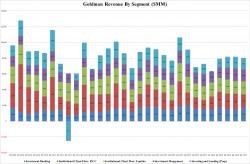

Broken down by key operating group, most segments reported numbers that beat expectations with the exception of FICC: