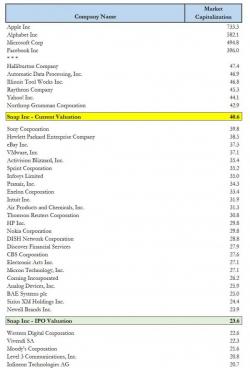

SNAP Surges Above $40 Billion - Bigger Than Ebay Or Sony

Desperate buyers - fearful of missing out on the next Facebook - are panic-bidding Snap's stock price this morning. Up 17% to $29 the cash-losing company is now worth almost $41 billion - more than Ebay or Sony...

We wil have to wait for Monday/Tuesday for the shorts to appear (T+3)...

The question seems to be - Facebook, Twitter, or... Pets.com?