US Government Revenues Suffer Biggest Drop Since The Financial Crisis

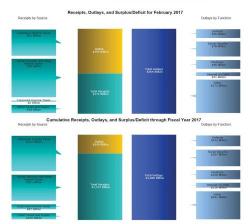

On the surface, today's monthly budget statement was disappointing: in February the US Treasury brought in total receipts of $172 billion, versus outlays of $364 billion, resulting in a decicit of $192 billion, more than tha $190 billion expected (if in line with last year's $192.6 billion deficit). For the fiscal year through Feb. 28, the total US budget deficit was $349 billion, virtually identical to the $351 billion deficit over the same period in 2016 and set to keep rising this year and for the foreseeable future.