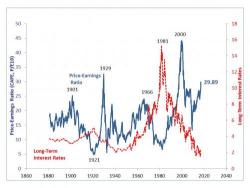

"Last Time US Stocks Were So Expensive, This Happened"

By Nicholas Colas of Convergex

Last Time US Stocks Were So Expensive, This Happened

By Nicholas Colas of Convergex

Last Time US Stocks Were So Expensive, This Happened

By EconMatters

We discuss the quiet news that Boeing is actually cutting jobs when they are not doing a Trump Style Media Promotional event for television cameras in this video. You cannot create actual, real demand out of thin air, real economics matter for companies like Boeing.

Submitted by Paul Brodsky of Macro Allocation Inc.

Get Angry

"When everyone else is losing their heads, it is important to keep yours."- Marie Antoinette

Just a quick note to my ZH friends that the banking system has been down this afternoon since about 11:30am for many banks in Texas (possibly all?) and apparently Oklahoma, too.

I have confirmed this firsthand. Have any of you been affected?

David Brock, founder Media Matters and one of Hillary’s biggest donors, laundered taxpayers money and funnelled it into the Clinton Campaign, according to an investigation. Brock has been found guilty of taking part in a scheme that laundered taxpayer money to fund the presidential campaigns of both Barack Obama and Hillary Clinton.